-

观点

观点

AI只是巨头的“玩具”?中小企业主应用AI可以在5个方面受益

人工智能(AI:Artificial Intelligence)和机器学习(ML:Machine Learning)常常与谷歌和亚马逊等技术巨人联系在一起,因为这些大公司创造了最流行的机器学习平台。由于高效的人工智能/ 机器学习解决方案需要大量数据来训练,小公司因为这些昂贵的成本,往往不愿意将人工智能融入他们的业务流程中。我认为这些担忧被夸大了,现在把你的小公司变成一个全面的数据驱动公司,可能比你想象的更容易。为了证明这一点,这里有中小公司如何启动AI的五个简单技巧。

智能的CRM

CRM系统旨在通过不同渠道(例如电子邮件、电话、社交媒体)收集有关消费者的信息,为销售人员提供一个集成的环境,以便管理与当前和潜在的消费者互动情况,并自动营销和指导行动。

如今小企业可以受益于Salesforce平台提供的智能功能。2016年,Salesforce推出Einstein AI平台,它允许开发者将AI功能整合到Salesforce的CRM应用上。Einstein AI可以帮助中小企业记录电话交谈、电子邮件、社交媒体帖子和客户评论内容,进而分析消费者情绪,评估客户反馈,并据此调整营销和组织活动。利用这些平台,小企业的销售人员可以更好地了解客户意图,查询自动获取的销售线索,最终达成个性化营销。借助人工智能CRM,小企业可以从客户数据中自动获取更多的信息,使他们的营销和销售团队更高效,消费者更满意。

目前国内市场中,CRM服务商销售易和百会CRM(Zoho中国)都提出了智能CRM概念,但是其智能能力多集中在相似客户推荐和优化重复性工流程等方面,对客户动态理解等方面还存在能力缺失。Salesforce推出的Einstein AI平台,在管理和分析客户内容方面,更类似国内一些营销云的功能,对inbound(域内流量)和outbound(域外流量)进行分析。

智能客服解决方案

如何高效的提供客户服务是保持客户满意的关键组成部分。然而,客户服务质量可能随着枯燥和重复性的工作而恶化,客服人员希望专注于提供独特的支持消费体验。

为了使客户服务更高效,小企业可以将AI能力集成到内部客户服务系统中。例如,像DigitalGenius(结合人工和智能的客服,2016年获得410万美元融资)这样的企业,可以帮助客户通过邮件、社交网络、短信、聊天界面管理客服咨询。以人工智能的方式自动回答问题,或者快速将回答建议分配到人工团队,由人工修改后回答客户问题。通过在客户服务中使用人工智能,小型企业可以从根本上减少重复问题和平均处理时间,从而达到提高员工和客户满意度的最终目标。

DigitalGenius定位服务于SMB,支持接入Salesforce、Zendesk、Oracle等主流客服平台,国内缺乏类似模式的智能客服企业。不过智能客服在国内是相对成熟的领域,企业有几十家可以选择,比如Udesk今年11月份推出了智能客服大数据平台Udesk Insight;阿里网易七鱼的“一触即达”功能,可以让智能客服机器人具有上下文理解、多轮会话能力,在智能能力表现上都可圈可点。

智慧营销

有效地管理营销预算往往需要深厚的专业知识,这就给小企业带来了额外的人力成本。幸运的是,现在的小企业可以通过人工智能解决方案来有效地使用预算。小企业可以委托Acquisio(以机器学习技术管理中小企业的广告)管理营销活动和营销业务,Acquisio通过多种渠道(如广告、脸谱网、Bing),分析广告表现并做出合理的建议,最终在PPC(按点击付费)效益最好的渠道分配预算。

利用多重算法分析客户与市场竞争对手之间的关系,这样的人工智能营销解决方案可以让小公司找到最好的营销策略,并大大减少CPC(投放的广告被点击,需要支付一定费用)要付出的高昂成本。智能商业工具和预算支出的合理管控意味着节约了额外的市场营销人员成本。

国外数字营销领先国内很多,比如Adobe、Hubspot等企业体量多在数十亿美元。国内数字营销的领先者是BAT等企业,比如阿里妈妈智能营销引擎——OCP“X”(包含OCPC、OCPM),以超大规模机器学习,智能计算每一个PV的流量价值,从而合理出价。

智能的竞争情报供给

当友商产生或者更新的内容达到每一天几百字节,便可能很难追踪他们的策略。但了解竞争对手和市场趋势,对于保持竞争力至关重要。

幸运的是,像Crayon这样的人工智能竞争分析工具可以帮助你解决这一难题。Crayon可以在不同的渠道(网站,社交媒体,网络应用)跟踪你的竞争对手,与强大的自然语言处理和商业指标相结合,分析其价格变化、微妙的信息修改和公关活动,这种功能可以让小企业更好地了解竞争对手的战略变化。此外,AI使竞争情报包括强大的分析功能,可以即时识别竞争对手产品的缺口,弱点和长处,及时反馈来调整自己的经营策略,防止被竞争对手超越。

据了解销售易近期发布智能CRM产品,可以智能整理企业客户的雷达图,包括企业体量、业务方面多维度信息聚合体现。另外会提供客户业务和人员变动信息,提醒商务人员适时关注这家企业。但与Crayon Data能分析竞争对手的优劣点及战略调整,还是本质不同,遗憾的是在国内并没有发现能提供类似功能的公司。(Crayon Data类似一些舆情大数据公司,但国内舆情公司多应用在政务领域)

成熟的智慧商业解决方案

如今,小型企业可以将AI工具嵌入到涉及数据的业务流程中。利用最先进的倾向性分析、分类和预测算法,小企业可以立即从他们的任何数据中提取有用的商业见解。

例如,像Monkey Learn(文本机器学习服务商)这样的人工智能工具,小公司可以在谷歌表格、CSV和Excel数据中使用倾向性分析和实体提取等方法,而无需任何编码。它易于集成,而且该平台还支持自动分类、标记和处理票据,以及对入站电子邮件和其他通信信息进行分类。该系统还可以用来分析产品的评论,分析其中实用的商业见解并将其提炼成有用的报告。所有这些特性,将节省小企业审查其相关数据所需的成本和时间。

将企业内部数据处理自动化,是当前的大数据领域比较火的一个领域。在文本数据挖掘方面,相关的案例有达观数据帮助大型企业自动化整理内部的文档资料,将合同文件结构化。如Monkey Learn对企业多种资料和外来信息进行分析理解。目前国内类似的服务商很稀缺,因为提供这种服务的技术门槛高,部署过程复杂。

当前AI /ML市场蓬勃发展,中小企业有更多的选项来启动他们的AI策略。小型公司可以使用便捷的接口和高效的机器学习功能,将他们的数据和工作流程接入到智能平台,而不是雇用科学家和营销专家做额外的工作。与商业智能相结合的工作流自动化将节省小企业的时间和成本,同时使他们在新兴的数据驱动经济中保持竞争力。

本文翻译自:https://www.entrepreneur.com/article/302655

-

观点

观点

【2028:AI创造了哪些工作】未来10年21个核心工作岗位

来源:cognizant.com

编译:费欣欣

【导读】Cognizant信息技术公司资助进行了一项调查,根据今天可观察到的主要宏观经济、政治、人口、社会、文化、商业和技术趋势,提出了21个将在未来10年内出现并将成为未来工作基石的新工作,从个人信息交易员到人体器官开发师,我们的生活正在被自动化和人工智能改变,报告还到了AI业务经理、IT自动化设计师,说不定未来你就将从事这样一份工作,一起来看。

关于人工智能对未来经济的影响预测有很多,从生产力大幅提高到整个经济完全湮没。很显然,没有人真正知道把能够自主思考的机器引入生活将如何塑造我们的世界。

但是,至少初步看,我们有一些保持乐观的理由:根据本月Glassdoor经济研究公司(一个分析劳动力市场的网站)的调查,由于人工智能的兴起,已经有不少新的就业机会/职业岗位被创造出来。

这些新的工作都是什么呢?你可能很容易想到AI软件工程师、数据科学家和AI项目经理。没错,在这些与AI相关的工作中,最常见的是AI软件工程师,占Glassdoor调查的512个人工智能相关工作岗位的11%。

同时,其他技术水平较低,与AI关系不是那么直接的岗位也在不断涌现。Glassdoor调查中还给出了bot撰稿人,他们专门撰写用于bot和其他会话界面的对话,以及新的用户体验设计师,这类工作主要产生自智能音箱和虚拟个人助理这样的新兴市场。研究知识产权子系统的律师以及报道人工智能的记者,这些岗位的需求也在增多。

另一方面,在日益自动化的世界中,又是谁在招聘这些人,驾驭劳动力市场的狂潮呢?答案主要是科技公司。在Glassdoor的分析中,排名前四位的分别是亚马逊、英伟达、微软和IBM,富国银行也榜上有名。

未来10年21大工作岗位:未来社会工作的基石

今天我们要介绍的,是由Cognizant信息技术公司资助进行的调查,他们专门制作了一份有关AI相关工作未来图景的报告,统计了未来10年21个关键工作岗位,报告根据“今天可观察到的主要宏观经济、政治、人口、社会、文化、商业和技术趋势,提出了21个将在未来10年内出现并将成为未来工作基石的新工作”。

未来,工作将发生改变,但不会彻底消失。许多工作岗位将被淘汰,许多工人将努力适应他们所理解的“工作”的消失,并且发现很难适应他们不了解的工作。转变将是痛苦的,对我们所有人来说转变都不是一件容易的事情。但是,没有工作的世界是一个幻想,与托马斯·莫尔的“乌托邦”无异。

作者指出,他们在编写本报告时设想了可能在当今可观察到的主要宏观经济、政治、人口、社会、文化、商业和技术趋势内出现的数百个工作,考虑了诸如人口增长、人口老龄化、民粹主义、环境保护主义、移民、自动化,以及量子物理、人工智能、生物技术、空间探索、网络安全和虚拟现实技术等多方面综合原因。

他们考虑的工作种类也确实五花八门:碳元素培育师(carbon farmers),虚拟形象设计师,加密货币套利者,个人数据交易员、人体器官开发者,教机器人英语的人类教师,机器人理疗师,机器人美容顾问,藻类农民,自动驾驶车队停车员,Snapchat成瘾治疗师,城市垂直农场农民,以及Hyperloop施工经理。报告表示,“这些都是年轻一代接下来可能从事的工作”。

报告中给出的21种工作都有望在短期内(未来十年)大幅增加,成为生活中常见的职业。作者表示,他们相信这些工作都将创造大量的就业机会。

走向2028:下一个十年或许你就将从事这样一份工作

下图展示了技术含量从低到高的21个职位,下面我们做简单介绍。了解更多可以下载PDF(英文):https://www.cognizant.com/whitepapers/21-jobs-of-the-future-a-guide-to-getting-and-staying-employed-over-the-next-10-years-codex3049.pdf

技术含量(低到中等)

陪散步/陪聊(Walker/Talker)

数字裁缝(Digital Tailor)

健身坚持顾问(Fitness Commitment Counselor)

个人记忆收藏管理员(Personal Memory Curator)

虚拟商店导购(Virtual Store Sherpa)

伦理资源经理(Ethical Sourcing Manager)

高速路控制员(Highway Controller)

AI业务开发经理(AI Business Development Manager)

人机协作经理(Man-Machine Teaming Manager)

IT自动化设计师(Bring Your Own IT Facilitator)

个人数据交易员(Personal Data Broker)

技术含量(中到高等)

基因组合总监(Genomic Portfolio Director)

金融健康教练(Financial Wellness Coach)

首席信托官(Chief Trust Officer)

数据侦探(Data Detective)

虚拟城市分析师(Cyber City Analyst)

AI辅助医疗技术人员(AI-Assisted Healthcare Technician)

增强现实旅游开发商(Augmented Reality Journey Builder)

边缘计算主管(Master of Edge Computing)

量子机器学习分析师(Quantum Machine Learning Analyst)

按照出现的时间,未来5年将出现的工作:

数据侦探

IT自动化设计师

伦理资源经理

AI业务开发经理

边缘计算主管

陪散步/陪聊

健身坚持顾问

AI辅助医疗技术人员

未来10年将出现的工作

虚拟商店导购

个人数据交易员

个人记忆收藏管理员

增强现实旅游开发商

高速路控制员

基因多样化官(Genetic Diversity Officer)

最后,我们选取几个未来5年即将出现,并且与新智元读者群最接近的工作做简单介绍:

数据侦探:与组织中的个人和团队合作,调查物联网终端、设备、传感器、生物识别监视器、传统计算基础架构和次世代边缘计算、雾计算等生成的数据,给出有意义的业务答案和建议。目前,这些领域收集的大部分数据都是未经检验的。优秀的数据侦探将类似侦探一样,“到数据所在的地方去”,追踪数据所讲述的一切。好奇、无情、有韧性,懂得迂回外交,从来不接受“No”作为答案。

IT自动化设计师:经验丰富的业务IT专员,整合IT与数字化工作场所,领导创造利用数字化趋势的工作环境。工作目标是创建一个自动化的自助服务平台,让用户选择所需的应用程序,以及构建虚拟助理来改善员工的敏捷性、生产力和参与度,同时保持数据的控制、安全、治理和合规性。在这个角色中的人将创建一个持续可见的系统和供企业用户,包括员工、客户和承包商随时随地使用的工作环境,包括移动和桌面系统以及应用程序和服务。

AI业务开发经理:定义、开发和部署有效和有针对性的计划,以加速基础广泛的销售和业务开发活动。与销售、市场营销和合作伙伴团队密切合作,为客户和合作伙伴定位人工智能服务,并就公司已有的人工智能服务、平台、框架和基础设施实现的价值主张和收益提供指导。此外,还将定义和推动组织加快对AI客户和合作伙伴机会的销售和合作伙伴管理参与度。作为AI BDM,你还需要负责将从业务中收集的数据和信息综合为简洁的结果,为产品和销售团队(包括高级管理人员)提供战略性见解和有说服力的成果和观点。

边缘计算主管(MoEC):向CIO汇报,确定物联网路线图,评估技术要求、建立边缘处理单元的可行性,并衡量投资回报。MoEC将负责创建、维护和保护边缘计算环境,设计和开发硬件和软件,彻底检查现有网络基础设施的可靠性、效率和延迟性,并平衡网络和互联网络中的负载转移。此外,MoEC将通过区分应存储哪些类型的数据来建立云端关系,确保解决方案的可扩展性并解决边缘(城域、半城市和农村以及移动设备)。

了解更多,可以下载阅读这份在未来感中满是现实意味的报告:https://www.cognizant.com/whitepapers/21-jobs-of-the-future-a-guide-to-getting-and-staying-employed-over-the-next-10-years-codex3049.pdf

-

观点

观点

进军海外市场,中国的SaaS公司在“怕”什么?

最近一周都在华盛顿参加微软的WPC(全球合作伙伴)会议,在一个近2万人的会议中你唯一能做的事情就是去找认识的,不认识的人去各种聊天,从交流中获取灵感,一路同行的有几家国内的2B SaaS的企业创始人,我们一路从微软的产品、技术与生态合作聊起来,一直聊到我们自己身上,在想一个问题:

为什么中国的SaaS公司不做海外市场?

首先说下这个问题是怎么抛出来的吧,本次WPC会议放在华盛顿特区,因为人多就租用了华盛奇才队的主场开会,当你进入到近2万人的会场时,微软作为主办方要讲什么内容是其次的,首先有这么多人就足够震憾的了,因为这些人来自于全球140个国家,意味着微软把已经能覆盖的国家和地区都覆盖了,不得和佩服人家渠道覆盖能力,看着乌秧乌秧的人群,就觉的要做大生意,必须依靠伙伴的力量在全球布局来做,想着微软的生意就是靠着全球64000家伙伴帮着做起来的啊,能够聚集这么多企业就已经很牛B了!

再看看国内,即便是阿里云每年在杭州的云栖大会有3.5万人,还是以国内企业客户、伙伴为主,谈走出国门为时尚早。而微软有许多在中国伙伴的订单是来自于微软的全球客户,因为在中国的业务拓展,需要许多IT系统的本地化服务才拿到的订单,才有机会给这些全球企业提供本地化的IT系统服务,也只是整个大蛋糕中非常有限的一小块,因此本质上还是本土化的业务,而不是全球性质的业务。

那为什么很少有中国企业(华为算是一家全球布局的企业)能够在全球市场中能够做到如此之大的手笔与布局的呢?聊来聊去应该会有几个主要的原因:

1、首先是国家层面的人才供应链的封闭与开放性有较大差距。

现在中国的人才供应主要还是依靠本土,而很少使用外来移民,整体来说还是一个相对封闭的系统;但在硅谷就不一样了,我之前写过一篇文章:从《硅谷之谜》找到创新的基因-叛逆与宽容,文中写道:旧金山湾区,从19世纪的淘金热开始之后,这里吸引了全球各类的冒险家来到这里淘金,包括美洲的墨西哥、秘鲁、智利,还有欧洲人和中国人(华工),全世界的淘金者来到这里都有一个很现实的目的--发财!来自全世界的人自然就带来了各自的文化没有哪个文化占主导地位,自然而然形成了多元的文化,当然也有共同的特征--爱冒险!这个特征再加上当地独特的政治和文化:追求各族群平等机会的同时,强调个人奋斗的保守主义,被视为其他地区所没有的优势。

当然,加州的保守主义使得人们习惯于靠自己的努力走出困境而不是寻求政府的帮助,政府之手就不会伸的这么长,同时加州人喜欢自己动手,这也是硅谷的DIY文化的起源所在(硅谷的企业创始人都是工程师,讲究自己动手快速实现最初的创意)!

2、中国企业市场已经是一个Big Enough的市场,使得中国的创业企业第一目标是做出符合中国市场需求的产品,而不是出海。

中国市场是多么让人羡慕,这一次在WPC会议上就可以知道了,和许多来参展的微软合作伙伴交流,他们除了是美国本土企业之外,还有来自于欧洲、中东等各个地区的伙伴,都对于中国14亿人口的市场有着无比的向往,都想着办法看看有没有机会能够进去。

而中国的创业企业自然想的就是做好中国市场,等着中国市场做好了再看有没有机会出去。但你真的有一天把中国市场做大了之后,可能你就再也出不去了呢,因为中国市场的客户已经把你的产品、营销、服务调校的只能服务于中国市场了,要再走出去的话就比较难了。

3、中国的市场处于快速发展的激烈竞争阶段,而海外市场的第一难点在于符合当地法规。

在会议期间,看了许多国外厂商的产品&解决方案,似乎往往用户的场景与痛点也不明显,但还生意做的挺大,看来国外的市场竞争没有国内这么激烈啊;但真的是这样吗?今天中午和一位来自于微软Bing的资深工程师(也是某个团队的负责人)交流了好久,他18年前就入职微软,谈到做全球化产品最难的事情就是要符合美国、欧洲等地的法律与法规,产品团队负责人最花精力的事情就是和公司的律师团队打交道,要采集任何一个UserID,都要得到律师团队的同意才行,不然分分钟就撞到枪口上去被罚几个亿。

而在国内市场则更多是产品与创意本身的竞争,立法与执法还相对滞后一些,这个时候就完全比拼的是产品与市场营销能力,但一旦要走向海外的话(特别是美国与欧洲市场),就会发现产品与市场营销处处受制。

4、企业创始人的全球化视角是制约SaaS企业走向全球的一个重要因素。

这次一路同行的有几位创始人都是从美国回国创业的,即便现在全家都在中国了,也仍然在美国把房子留着,有着海外背景的企业创始人自然而然的就能够将产品、营销、服务的全球化作为一个考虑选项,因为从创始人感知到海外市场的机会在哪里,知道如何在产品与营销中植入国际化要素;但如果创始人或核心管理团队中没有这个基因与背景的话,估计对于海外市场的情况也是两眼一摸黑,自然也就没有想着要做海外市场的推广了。

5、中国企业属于非英语语系国家,对于产品&市场营销来说语言不通是业务拓展的一大障碍。

从北美到南美,从中东到非洲再到澳洲,从印度到新家坡,不得不佩服当年日不落帝国的强大,把自己的语言推广到了全球,也使得全球大部分的地区都已经是英语语系国家,英语已经成为这些国家与地区跨领域交流的通用语言,因此美国企业要做国际化的推广,其实语言上来说就少了非常大的障碍。

但中国是汉语系的国家,要在英语系的国家推广业务自然就要跨过语言这个大门槛,而这个门槛不只只是自己的本地化销售人员懂英文就行的,而是要求从技术、产品、营销、交付、服务全价值链上的团队都要能够使用英文交流,这对于中国企业来说是一个非常高的门槛,这也是中国企业很难走出去的一大原因。(顺便说一句,对于下一代的教育,英语、演讲与呈现、逻辑思维三大块就显的非常重要了!

以上是基于本次会议期间交流时零零星星内容汇总起来的几个点,这是中国企业为什么走不出去的原因,但反过来说,现在越来越多的中国企业正在走出去,而且已经大获成功。中国企业走出去是必然,甚至我们可以向手机制造厂商传音学习,在国内造的手机国内根本就买不到,但在非洲就不声不响地做成了老大!按照这个趋势来说,中国的2B SaaS企业也有大把机会走出海外干出不一样的精彩。

来源:公众号 童继龙笔记

作者:童继龙

-

观点

观点

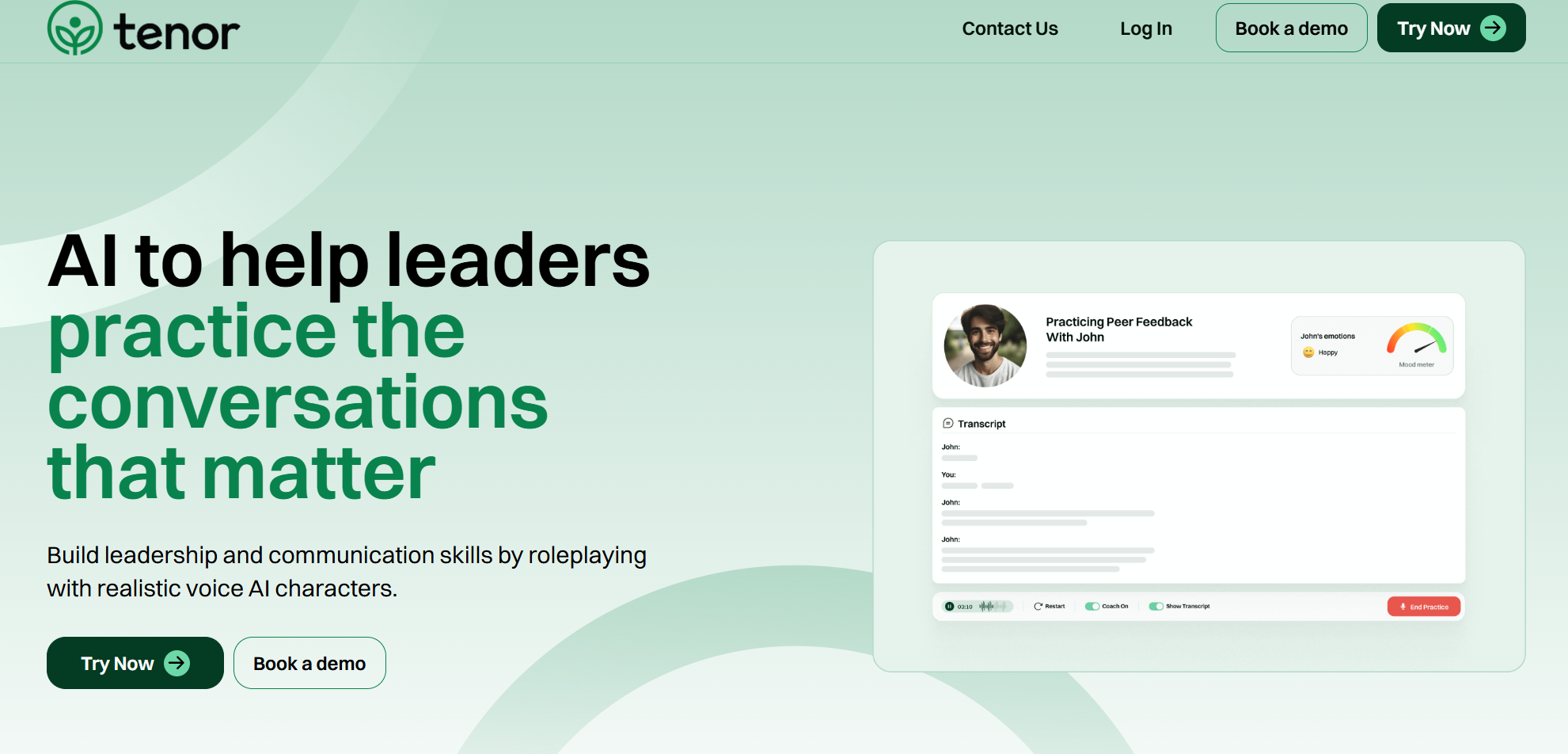

当HR碰上AI,这里有一个“三步走”计划

当工业革命开始的时候,科技带给我们的价值是机械的自动化和劳动生产效率的提高,劳动力的构成也因此而变得多元。随着2000年电脑和互联网的普及,不仅信息处理的效率飙升,我们也打破了物理环境的局限,实现了信息的连通性和人才的流动性。

但技术红利给我们带来的生产力增长在2008年金融危机后就到达了瓶颈。而最近得以发展的传感器,人工智能,机器人等新兴技术会给我们带来怎样的变革呢?一个人平均需要3到5年的时间才能适应一次非连续性的技术突破,一个企业对于技术变革的适应只会更久。

当科技让世界扁平,企业可以通过快速复制达到巨大规模的时候,单个个体通过科技赋能所产生的力量也已今非昔比。世界的中心从商品转向到了人才。但同时我们也观察到,一个成熟企业随着员工数量的增多,创造力却在不断下降。随着业务发展速度的加快和组织形态的日益复杂,企业意识到了人才的吸引力和组织结构的敏捷性尤为重要。在人力资源的工作中,我们看到了一些可以用科技去重新定义的机会,HR在企业应对技术变革时可以起到的作用也至关重要。

理智与情感兼备,才是好的HR

理智,指的是用数据驱动的思维去发现,理解和解决问题。2016年美国企业在HR Tech投入比2015年增加了46%,到达140亿美金的市场规模。那么HR只有对日新月异的硬科技保持敏感,才能更早地让企业从传统的工作流程和陈旧的管理方式中转型,比如考勤打卡和KPI绩效考核。

情感,指的是工作中所产生的情绪和感受。我们在工作中和同事待在一起的时间远远超过和父母孩子相处的时间。员工对工作体验的期望会越来越高,他们希望有多元的文化,技能的积累和心灵的成长。如果把员工当做是上帝,那么HR这个产品经理,就要用心去设计每一个与员工交互的界面。员工期待的是简单流畅的体验,这就要求所有的企业服务走向消费化(Consumerization of Enterprise Software),所有以人员为基础的管理方式要转变为以人性为根本。

HR Tech的三个阶段

第一阶段:自动化流程和信息化集成

在这个阶段,人力资源系统做的事情是让公司的HR更加便捷地去管理公司员工。传统的SaaS主要是把人力资源的信息标准化,流程自动化。而新近的创业公司则在尝试用AI完成面试安排,会议时间协调等重复性高又标准化的任务。

第二阶段:关于人才的数据积累

企业的ERP存储了基于业务经营管理的数据,CRM记录了关于客户的数据,那么关于员工的数据,和人才的数据则应该统一实时地集中管理起来。

第三阶段:通过数据分析建造一个可以预测和辅助决策的智能系统

只有当构建了自动采集实时更新的数据库之后,智能的系统才能构建出来。对企业的经营做预测性分析且在重要的决策上起到辅助判断的作用。

AI+HR到底可以颠覆什么(Acquisition,Engagement,Analytics)

1. 人才招募Talent Acquisition

HR对招聘的理解早就不是招人这么简单,这是一场和业务部门肩并肩的全球人才供应链争夺战役。求贤若渴的企业不仅需要有人才大数据的支撑,还需要和人才之间达成使命感的认同和情感的连接。

-从手动到自动

1994年,Monster推出了世界上第一个招聘网站。23年后的今天,纷杂的招聘渠道和落后的简历筛选技术再次造成了企业与求职者之间的信息不对称。简历太多,HR筛不完;简历太少,HR招不到。候选人投递的简历往往石沉大海。而HR每天收到大量的简历中,符合岗位要求的却是寥寥无几。招聘中70%的工作时间都用来处理简历,包括要登录多个招聘平台,在人才库进行搜索和筛选。在美国招聘的人效早就到达了瓶颈,70%的公司都在使用第三方的ATS(Applicant Tracking Systems)来提高效率。

-从被动到主动

一个优秀的人才能为企业产生的价值远高于以往,以后的人才市场会是永久性的紧缺。好的人才都是被动求职者,他们不需要主动地去寻找工作。如果希望招募到最好的人才,公司就一定要脱离被动的筛查而转变为主动出击。同时HR也需要用市场营销的角度去思考,用社交化的手段去建立一个对人才有吸引力的公司品牌。美国创业公司Textio正在帮助HR润色职位描述和宣传文案。Textio分析了大量可以吸引更多候选人的用词和表达方式,从而对HR起草的招聘文案进行评分,提出修改建议。比如它会更换一些过时的说法,也会针对不同性别受众的文字偏好做相应的文案调整。

-从随机到精准

候选人的匹配远不止是技能匹配那么简单。即便所有公司都在招聘前端工程师的岗位,但最终不同的团队领导和公司文化所选择的候选人会各不相同。那么在众多的简历中,如何判断哪位候选人最适合当前的职位呢?我们的被投企业Celential.ai正在用机器学习的技术自动排序人才管道中的职位候选人。它会用自然语言处理技术分析候选人的简历,根据工作经历、表现、任期和流动率等信号对候选人和当前职位的匹配度打分。系统还会从简历数据库中学习成功的招聘案例,从而建立人才模型,更准确地预测候选人未来的表现。

-从线下到线上

在美国40%的求职面试都是通过线上完成的。传统的面试是一个主观和非标准化的过程。人工智能面试分析公司HireVue正致力于通过提取原始视频中的措辞、面部微表情等信号来评估候选人是否符合岗位需求。NLP技术用于分析候选人的回答,计算机视觉技术则用于解读表情和其他非语言因素,试图用组织行为学的心理分析做预测。这个筛选方式主要的卖点就是提高面试效率,针对大批量同质化高的初级岗位快速筛选出进入下一轮人工面试的候选人。但是这些测评方式的效果如何,目前并没有明确的结论。

2. 员工敬业度Talent Engagement

人才是一个企业真正的血脉。当招募人才变难的时候,防止人才的流失才是最好的招聘方法。根据哈佛商业评论的统计,员工在一个企业的平均工作年限已经缩短到3.8年,其中26.7%的员工会在第一年就主动提出离职。在拥有全世界最好员工敬业度数据的美国,也只有33%的人表示对自己的工作满意。如果说公司是你的产品,而员工是你的客户。那么我们用NPS的考核方式去看看,你的员工有多少会向朋友推荐自己的公司?又有多少人在工作中真的像招聘宣传图片里的样子?

公司信奉用户体验是第一位的,最好的用户体验就一定不是偶然发生的。在设计用户体验的时候,产品经理都会先去了解他们的用户到底是什么样的一群人,会有哪些需求。他们会和用户一起交流讨论去挖掘新的想法,会在实际的产品中不断的迭代和测试新的方案。我相信一个伟大的公司,一定会有一种自主,专业,又赋有使命感的员工体验,而这种体验一定不是偶然发生的。

-从To B到To C

美国创业公司Glint尝试用简短无记名的员工意见评估代替传统的员工满意度调查问卷,然后利用机器学习、自然语言处理和预测分析技术,生成报告来解读员工对公司管理、福利待遇和企业文化的感受,为企业提出改进建议。在To C的Yelp和IMDB里,我们见证了用户评分和评论的力量。今天的To B员工系统里,也从陈旧的填表演进到了只是让鼠标悬停在一个五颗星的框里就可以评分的反馈。在现代灵活而分散的组织形态下,如果能及时识别出这些“不开心”的员工,并提出相应的改善计划,就能够有效提高员工的敬业度。

-从亡羊补牢到防微杜渐

有88%的员工认为他们的入职体验很糟糕。通过自助服务和个性化体验,HR可以帮助新员工顺利开展工作。在候选人接受雇佣录取后,他们需要上传许多入职材料,同时对公司的规章制度还很陌生。HR大量的时间花在了处理这些琐碎的文案工作中。如果这些重复性高的流程细节可以交给聊天机器人,他们则可以专注于员工正在适应的新的工作岗位上。入职培训其实也存在着同样的痛点。如何在企业内部建立起知识图谱,给新员工推荐碎片化培训材料,并且依据学习进度推荐相关的内容也会是体验提升的重要环节。

3. 人才数据Talent Analytics

大部分关于业务的决策都是数据驱动的,那么关于人的数据呢?现在美国只有8%的企业表示,他们具备可用的员工工作数据。

-Hindsight读史以明鉴,管理层需要对过去的成功和失败有更清晰的认识

第一阶段的数据分析核心是可视化工具,提供和跟踪一个之前没有的数据集,比如用员工数据去做业务数据的相关性分析。大多企业现在只能看到核心HR数据和业务数据(比如营业额,任职情况,绩效评级),但以后会有更完善的组织关系数据(地点位置,员工协作,团队信息)以及个人工作数据(时间分配,情绪,健康)。随着这个数据集的不断扩大,管理层对经营成败和人员组织的关系会有更深刻的见解。比如为什么有些地方销售的生产力高,而有些分公司却出现欺诈盗窃的行为?

-Insight实时的数据,才能更好地支持日常快速的商业决策

平均而言,一个组织的生产力在绩效考核时会下降40%,因为整个团队都忙着填表,而不是专注于手头的工作。大家可能认为OKR很专业,Google采用OKR,但其实微软做的更彻底,直接取消绩效考核,采用反馈机制。这几年美国出现了像BetterWorks和Reflektive这样的实现考核自动化的软件,使经理和员工能够主动咨询对当前工作的反馈意见并分享数据讨论绩效目标,促进了反馈的真诚性和团队的士气。他们正从一种从自上而下,流程驱动的方法转变为一种更敏捷持续,基于反馈的方法。

-Foresight预测未来,辅助企业制定更好的商业战略

预测性模型可以发挥作用的地方有很多,比如柔性人员管理的需求。分享经济和众包市场改变了我们对劳动力管理的需求。从计划和安排人力,逐渐转移到根据需求预测来实时的调配人力。还有更多的数据分析包括预测高绩效员工的离职,并指出避免员工流失的最佳途径。创业公司Hi-Q Labs开发了一种仅通过外部数据(如居住地,上下班距离,职位,社交网络发布的数据等)就可以预测员工留存率的方案,号称比使用内部数据的预测更准确。管理者有了基于数据驱动的指导,帮助他或她了解最可行的保留高绩效员工的途径。

无论公司大小,人力资源中还有太多的问题,而我们知道的却太少。Gallup在美国2017年的员工调查中表示,在任何一个企业中平均51%的员工在找寻新的工作,79%的人认为他们的工作中缺乏指导。我希望更多的了解他们是谁和公司能做些什么。用AI取代HR是不可能的,现在的技术并不具备真正的智能,也没有社交协作和情感沟通的能力。但在写这篇文章的过程中,我很开心地看到创业者面对这些问题提出了很多独特的解决方案。期待更多的公司把AI融入到HR的环节里为所有人都重新定义一个更好的工作体验。

来源:金沙江创投

作者:张予彤

-

观点

观点

AI 技术能让老板更好地监督你……这是好事还是坏事?

编者按:本文作者 Dave Rocker 是管理咨询公司 Rocker Group, LLC 的执行合伙人,他在本文中探讨了人工智能技术在现代企业办公之中的应用,不仅能够提高员工的生产力,而且能够将老板和员工的关系引导向一个更有趣的方向。

在日常生活中,我们与 AI 可能有多次交互机会,但其中许多交互我们自己可能都没意识到。人工智能已经嵌入到应用非常广泛的一些消费技术中,许多消费者也都没注意到。因此,要说人工智能为现代办公注入了更强大的功能自然也不足为奇。以企业为重点的人工智能技术能够将老板和员工的关系引导向一个更有趣的方向,并且这一转型目前已经开始发生。

对于老板来说,最本质的一点在于确保企业发挥最大的潜力。从这一角度来看,人工智能在企业领域的未来看起来非常光明。因为人工智能技术能够简化操作流程,将企业的效率提升到前所未有的水平。而这要归功于先进的数据收集和分析技术,首席执行官们得益于此,到 2035 年就可以将企业生产力提高 40% 之多。技术的进步不断刷新人们的期望,企业工作领域的全面变革似乎也越来越有可能发生。

AI 提高生产力

建立在 AI 基础上的监督绝不是痴人说梦,实际上,这已经是现实了。技术先驱日立公司宣布公司安装人工智能工具的仓库生产力提高了 8%,这些人工智能工具主要用于分配任务并确定实现这些任务所需的新策略。除此之外,他们还能够适应各种变化。日立希望这些人工智能工具收集的信息很快就能应用于医疗保健、交通运输以及其他各行各业之中。

无论怎样,企业老板都有责任确保员工能够高效地利用自己的工作时间,而在这个方面,人工智能可以很好的发挥作用。科技公司 Veriato 致力于从事员工管理软件,能够监控所有电脑的使用情况。它的 AI 工具能够记录公司计算机上的所有活动,并对这些数据进行分析,以确定谁在工作上投入了更多的时间,谁又在工作时间偷懒。它甚至可以通过对电子邮件和通讯消息的解读来评估员工工作士气。

有些人可能会认为这样提高生产率的技术具有侵犯个人隐私的嫌疑,但只要是在公司时间里,你所做的与工作无关的一切都是在损失公司的资金。因此,从这一角度来看,雇主利用人工智能解决方案来确保员工的实际工作时间也是合理的一种做法。

但仍然无法破解沟通问题

从目前情况来看,人工智能可以通过简化流程来帮助大多数公司实现提升效率的目标,而不需要昂贵的审计和评估投入。但是,在将这些责任转移到软件的过程中,公司会面临损坏人际沟通和关系的眼中风险。

同其他任何关系一样,良好的工作关系也是建立在强有力的沟通基础之上。优秀的领导者知道如何通过灵活性,来细微平衡员工需求与公司指令之间的差异达到激励员工的目的。即便是采用最乐观的预测标准,人工智能距解决这些整体挑战至少还需要十年的时间。

要创建一种能够满足有效人际沟通所达到的细微性区别处理效果的人工智能技术,显然还有很长的路要走。但即便这样的一项技术发展到完善的程度,它是否真的就能满足所有员工的不同需求呢?至少现在,我们还很难想象一位人工智能老板能够针对某位员工来一次提升士气的谈话。即便是 2017 年所出现的最为先进的沟通工具,也无法具备像一位有经验的管理者所具有的对背景和细微差别的那种掌握能力。

而从另一方面来说,并不见得每一位老板都发挥了优秀的管理角色,随着软件解决方案达到惊人的数量(并且能力也在日渐增长),AI 至少可以取代那些拖员工后腿的坑爹老板。在你表现优秀的时候,一位人工智能老板无法拍拍你的后背表示肯定,但至少他也不会发表不当的评论或者是做出错误的指示去浪费彼此的时间。

未来发展方向

我们目前正处于 AI 变革的浪潮之中。无论好坏,无论是否紧要,这就是当前所发生的事情。而这些技术能否被采用将取决于一个因素:它们是否能够提高盈利?答案取决于数字,而不是人类被取代是否会引发任何不安的感觉。那老板与员工的关系是否适合通过 AI 来改善呢?与软件一样,这取决于编程。

原文链接:https://venturebeat.com/2017/11/18/ai-could-help-your-boss-track-your-performance-for-better-or-for-worse/

-

观点

观点

公司为员工植入芯片,这会是未来的大势所趋吗?

编者按:几十年前在科幻作品中才会出现是识别技术,现在已经成了很稀松平常的事情。现代生活中,刷脸、指纹解锁、虹膜识别就跟刷卡一样平常。芯片识别大家应该也很熟悉,各种证件、护照、身份证里都有这样的芯片。而植入式芯片在动物身上的应用也已经有几十年了,发展很成熟。但是如果有一天,上班的时候,老板告诉你要在你身上植入芯片来“打卡”,你会接受吗?Amal Graafstra是一个美国的一个科技创业者,他因为讨厌开门、讨厌钥匙,在自己手中植入的 RFID 芯片,配合读卡器,他就能轻松出入自己的家和办公室。但是成为一个“半机械人”,会是未来的潮流吗?本文编译自medium的原题为“Microchipping workers is a thing. Should it be?”的文章

Amal Graafstra 本人

每当Amal Graafstra迈入自己的办公室、登入自己的电脑,或者走进家门,他都不需要四处摸索钥匙,不用找电子卡,连输密码都不需要。他只需挥一挥手,就能进入了。

那是因为Amal Graafstra身上植入了芯片。

Graafstra在手掌里植入了一个细长的电子设备,大约一厘米长。这个设备依靠近场通信技术(NFC),让联网的门或其他设备识别确实是他走近了。 Graafstra需要与目标保持几厘米的距离,设备才能正常工作,大约两个磁铁吸到一起时的距离。

近场通信(英语:Near-field communication,NFC),又称近距离无线通信,是一套通信协议,让两个电子设备(其中一个通常是移动设备,例如智能手机)在相距几厘米之内进行通信。 NFC 被用于非接触支付系统,如同过去的信用卡与电子票券、智能卡一般,将允许移动支付取代或支持这类系统。NFC 应用于社交网络,分享联系方式、照片、视频或文件。具备 NFC 功能的设备可以充当电子身份证和钥匙卡。NFC 提供了设置简便的低速连接,也可用于引导能力更强的无线连接。

Graafstra设想,在不远的将来,很多人身上都会植入芯片——不管是需要有进入警备森严地区许可的雇员,还是需要有读取敏感信息、获取重要文件的权限的任何人。他说,给雇员植入芯片或许会是下一代人在企业安全方面选择的解决方案。比起密码、身份证卡片、甚至是面部识别这类生物学信息,芯片被黑的可能性比较小,而且完全没有任何“阻力”。

植入芯片包括金属芯片和天线组成,包裹在生物兼容的无菌玻璃圆柱体里。植入芯片之后,员工就无需使用徽章,密码或钥匙,他们也不用担心忘带或丢失这些新居,公司也不必再花费太多的精力和时间来管理这些凭据,“Graafstra说。 他公司的芯片可以由国家注册的人体穿孔器来植入。

Graafstra在“给公司雇员植入微型芯片”方面有很大的利益。 他经营的创业公司Dangerous Things,将这项技术出售给其他公司。 Graafstra说,公司采用这样一个前卫的名字,是为了吸引那些早期采用者,特别是通常渴望应用新技术的企业。 他说,在2016年,Dangerous Things售出了3万至4万个植入式设备。 虽然全世界只有五家公司正式向他们的工作人员提供Graafstra公司的产品,但他表示,这并不意味着这些公司是唯一愿意尝试可植入芯片的公司。

Graafstra说,苹果,谷歌和三星的员工也有进行采购,尽管这些公司并没有正式承认对这项技术的兴趣。 买家当然“不会站出来承认出来说'我们打算给员工植入芯片',他们可能只是试用一下,看看是否有趣...... 我觉得,有更多公司给员工买了这些东西,但不是向公众披露,也不会挂在嘴边。“Graafstra解释说。

微型芯片公司在今年夏天获得了全美的关注。自从Three Square Market,威斯康星州的一家自动贩卖机公司,让员工自愿植入微型芯片。Three Square Market公司还邀请了第三方公证,他们将芯片植入大约50名员工手中。 借助这些设备,Three Square Market的员工可以打开门,登录电脑,并用手轻轻一碰就能买到零食。这些芯片是由瑞典BioHax International公司制造。

我们不觉得植入芯片是一件很怪异的事,一开始我们也确实觉得奇怪,但是你也可以说‘芯片不错嘛,挺与众不同’。

——Three Square Market 的CEO Todd Westby

其他公司也可能效仿:Three Square Market与瑞典BioHax International合作,成为其在美国独家经销商。Three Square Market的CEO托德·韦斯比(Todd Westby)告诉一位电台记者,很多不同公司,包括医疗保健团体在内,都对微型芯片表示很有兴趣 “如果你是一家科技公司,这样的新鲜事其实很令人兴奋,”韦斯特比在八月份告诉CNBC。 “我们不认为这很奇怪了。 我们一开始决定这么做,只是因为我们认为这足够新奇...我想你可以说'很酷嘛,与众不同。'“

除了Graafstra之外,Dangerous Things的另外四名员工已经被植入了电子设备,插在他们的手中,在拇指和食指之间; 在他们的手臂上,在手腕上方; 或者在小指下面的肉肉的部分。

植入芯片是什么感觉? Three Square Market的韦斯比(Westby)向CNBC表示:“就跟穿皮鞋时,小脚趾有点被压到的感觉一样。”

尽管Westby和Graafstra对微型芯片热情高涨,但并不是所有人都为植入微型芯片的可能感到兴奋。 一方面,隐私方面就存在大问题。 美国亚利桑那州立大学跨学科研究小组,全球安全计划主任杰米·温特顿(Jamie Winterton)表示:“除了隐私问题之外,设备如何访问网络? 数据是否经过加密? 收集什么样的数据,存储时间多长?”他还说,“这个设备上应该存储多少隐私信息?这个问题在隐私方面就会引起另外一些争议。”

而且雇员们是不是真的能相信,雇主在工作时间之后不会追踪他们呢?杰米说:“我希望收集到的数据只包括对雇员的识别,'确认,这是某某,某某正在进出建筑物,”

除了隐私问题之外,还有一个问题:植入式芯片提供的便利性和安全性,是否太令人觉得毛骨悚然?或者,在雇佣关系中使用芯片,是否太“过分”了?Challenger, Gray & Christmas是一家聘用和再就业公司,其副总裁Andrew Challenger说,设备的“侵入”性会减小它的吸引力。 Challenger的公司跟踪调查各种职场趋势。“如果这是一个发展大趋势,那我会瞠目结舌。”

Challenger说,其实我们不需要微型芯片,因为每个人都携带着智能手机。 手机里大多数都包含射频识别编码的存储芯片,能在手机上存储信息“我们不需要为此去做植入手术。”

Graafstra说,微型芯片应该不会引起隐私问题。 他说,设备植入之后,只会靠近读取设备、需要读取信息的时候“通电并完成工作”。 他认为,能够真正拥有一个在人身上、不会受到攻击的“密码令牌”,这在以后会越来越重要。

网络安全风险市场研究公司的创始人兼主编,史蒂夫·摩根(Steve Morgan)说,虽然植入式设备“比连接有键盘的设备更安全”,但单靠这一点,无法使所有怀有恶意的“不良行为者”望而却步。

“在指挥系统的某个环节,有一些人能获得访问所有数字设备 - 即每种类型的软件和硬件的权限,不管合法还是非法访问。 这些设备也包括植入物。

——史蒂夫·摩根(Steve Morgan)

摩根在一封电子邮件中这样回复说。 例如,目前有新发现,植入式心脏起搏器的漏洞对患者可能有影响。这就突显了嵌入式技术其实并不安全。 摩根说:“社会面临的最大风险,是大家存在一些误解,有了一种虚假的安全感,并认为最新、最伟大的创新都能防黑客。”

原文链接:https://medium.com/cxo-magazine/microchipping-workers-is-a-thing-should-it-be-e74ea1de7cb9

-

观点

观点

AI进军招聘业,要如何应对求职中diss你的招聘机器人?

编者按:本文来自网易科技,编译:网易见外编译机器人。

随着人工智能(AI)技术的迅速发展,医疗保健、虚拟助理等行业也逐渐被改变,人们对AI取代人类角色的担忧也日益加剧。与此同时,在当今的商业世界中,部署AI平台的速度要比取代它们的速度更快。

虽然我们还没有确定AI技术的确切影响,但世界经济论坛最近发布的一份报告估计,到2022年,自动化将取代至少500万个工作岗位。今天有一件事是清楚的:AI正在推动人们的工作方式以及企业对未来员工的看法发生根本性改变。

除了承担重复性的任务外,我们还开发了许多有AI支持、与人类进行数字交流的技术,比如招聘和人力资源等。事实上,数以百万计的招聘人员目前都在使用像Ideal这样的AI和机器学习公司的技术,来扫描数以千计的简历和LinkedIn页面,以便精确地挑选出相关的求职者。

因此,如果你没有接到回电,那可能是因为AI将你排除在潜在的招聘范围之外。虽然一个平台可能会否定你在理想职位上的资格,但另一个平台可能会让你远离职业生涯的失误。

值得注意的是,AI在人力资源领域的效用远远不止于选择正确的求职者。由AI驱动的平台,如Plum,可以将求职者与公司的招聘职位进行匹配,目的是为了确定行为契合度。实际上,他们通过在招聘阶段记录的名字、教育和经验,完全消除了对简历的需要。他们会更多关注于你为何取得如此大的成功,并从你所取得的成就中寻找线索。

与此同时,Knockri使用视频来筛选潜在员工。这项技术通过视频回复来衡量求职者的口头和非语言沟通能力。与传统的视频面试平台不同,AI工具可以确保名字、性别、种族、甚至是口音都不会成为影响因素,从而帮助公司在短时间内找到最理想的求职者。

将来,求职者必须与AI系统合作,才能找到潜在的雇主和合适的职位。这一双重现实给那些想要换工作的人、找份更有挑战性工作的人或者仅仅是想要获得稳定收入的人带来了全新的挑战。为了跟上技术进步的速度,这里有些建议,以便帮助人类求职者获得那些没有心跳的机器都为之赞叹的简历。

1. 发挥你的创造力

如果你想要进入一家人力资源部门使用AI技术的新公司,不幸的是,你需要把简历设计技能留在家里。对于招聘人员来说,使用过滤软件寻找符合实际招聘信息的关键词是很正常的。那些看起来太普通或超出范围的简历会被机器人自动过滤。

是的,创造力可能是个优势,但它需要被考虑到。例如,如果你是一名软件工程师,你可以在编码测试中表达创造力,以展示一种独特而简单的解决复杂问题的方法。或者,如果你是一名平面设计师,那么在展示你的作品集时,布局、色彩搭配和字体选择是你的风格和能力的重要指标。最终,求职者应该以独特的视角来看待自己的价值,以便在竞争中脱颖而出。

2. 学会与机器人聊天

对于大多数拥有大规模招聘工作的公司来说,聊天机器人是他们的第一道防线。雇主通常会使用像Karen.ai这样的服务来筛选求职者。投递相同简历到多个职位的日子已经正式结束了。在由聊天机器人引导的面试过程中,以及传统的求职信中,如今的求职者必须将他们申请的特定职位的重要性放在优先考虑的位置上,而不是展示他们的个性或一般的职业轨迹。聊天机器人在整个在线讨论过程中对求职者进行评估。因此,他们需要以专业的方式与聊天机器人沟通,以获得更高的晋升机会。

3. 参与实习项目

企业实习现在已经成为大学教育的重要内容。但想象一下,你自己的项目可以让你测试潜在雇主,而不是反过来。绕过传统的雇佣策略是未来的方式,像Riipen这样的创业公司可以帮助学生避免痛苦的求职过程。该公司通过实习配对程序帮助学生获得最佳体验。AI正在幕后工作,让这个全新的人才精选通道成为现实。

4. 拥抱未来的职业生涯

我认为,向AI招聘的转变创造了一个就业搜索环境,而这种环境将会持续下去。企业将越来越多地使用基于AI的软件来对求职者进行分类。这意味着求职者需要用直白的语言来描述他们的背景,使用通用的语言来展示相关的工作经历。申请者还应准备进入招聘程序,让AI试图将他们理解为“人”,而不是作为一份成就清单。最终,对于需要面对拥挤就业市场和不断变化就业要求的求职者来说,了解如何为这些系统提供简历将变得势在必行。

-

观点

观点

从创业者年龄和投资取向,看国内外SaaS发展的差异

说到国内外SaaS产业发展的差异,在业内大多数人看来,或许没多大悬念。

不管是市场成熟度、产业规模、实际营收,还是玩家权重、产品国际化程度、客单价、客户付费意愿等,从目前看,国内外明显都不在同一水平线。市场发展的巨大差异,使得影响力较大的几大SaaS品牌,比如Workday、Salesforce、ServiceNow、Zendesk、Slack等成了国内竞相对标的对象。

不过在“SaaS创业和投资对创业者/团队平均年龄的选择”这一点上,国内和国外做到了神同步。

从以往统计数据看:SaaS项目的创业者和被投资者以60后和70后为主,而且多数要求创始团队有要有一定的技术或从业背景。为何会出现这样的情况?未来是否会发生变化?

SaaS创投对创业者年龄的选择

想创业,什么时候都不晚,不过并非每一行都是低门槛。

拿近年比较火的企业服务尤其是企业级SaaS创业来说,因为入行门槛偏高,就形成了一条鲜明的年龄分割线:入行者基本在35岁以上,拥有至少10年以上从业经验。

在对比当前主流SaaS公司的创始人/创业团队后,我们能进一步看到:国内现阶段这一领域的头部玩家基本是70后,在2010年前后开始大范围发力。国外SaaS产业比中国起步早10年左右,折射到创始人/团队年龄层次上,正好有近10年的差距,不少拓荒式人物在年龄上更靠前。比如PeopleSoft的创始人Dave Duffield,40后。2005年公司被甲骨文收购后,同年与Aneel Bhusri联合成立了workday,目前仍是SaaS HR领域的佼佼者。

2B领域创投缘何出现年龄鸿沟?

眼下80、90后乃至00后创业屡见不鲜,国内外2B领域的创业仍存在一定的年龄鸿沟,是巧合还是规律?

透过年龄,我们不难看到背后雪藏的某些东西,比如资源人脉、专业沉淀、资金知识储备等。正是这些因素进一步促成了“创业年龄提前”和“2B领域创业年龄整齐划一”的现状。

从专业化程度看,60后70后作为较早接触这块业务和产品的老兵,确实比从业的新兵更有优势。和2C领域创业关注短期风口、创意、爆发性等不同。2B领域创业,尤其是SaaS服务这块,对技术、经验、知识储备要求高,新生代创业势力在入行时会面临较高的门槛。

另外,经过几十年的发展,企服市场的竞争已经相当激烈,技术没壁垒,产品没优势,很容易被淘汰出局。在这种情况下,老兵上阵,成功率更高,也更容易打开局面。理才网创始人陈谏便是如此。他是国内最早一批人力资源管理软件(e-HR)实践者,为主流HR软件搭建了延续十几年的应用框架。曾参与硕旺HRMS、用友e-HR、BroadVision HR SaaS、金蝶s-HR等数代人力资源管理软件的研发。05年云计算在中国刚起步,率先开发SaaS产品,他还因此获评“中国SaaS HR第一人”。

成立理才网是他第三次创业,还是从最拿手的HRM切入,因此,2014年dayHR上线后,迅速蹿红为SaaS HR代表性产品。随后,陈谏带领团队趁热打铁,推出了daydao云平台,目前涵盖HR、OA、CRM、FI、SCM、舆情管理、餐饮管理、交通管理等多个领域。

和陈谏一样,出走传统软件行业投身到SaaS创业的案例有很多,比如智思云创始人王存、仁云科技创始人张向党等,目前在细分市场也形成一定规模。在国外,依托创始团队的专业背景,尤其是技术背景,则诞生出Salesforce、workday等一批明星SaaS公司。

从成本看,企业级SaaS产品开发成本高,前期投入大,大规模盈利又需要较长的时间周期。在个人资金储备不充裕或民间投资不到位的情况下,年轻的创业者很少愿意承担这么大的风险,持久内耗更是难以为继,这也使得资金、资源相对充沛的6070后老兵,成为这一领域创业的主力军。

做企业级SaaS服务投入到底有多大?

有国际调查机构曾统计:主流SaaS公司前期花在研发上的成本约为50%-70%%,部分产品导向型公司研发成本更高,可以占到90%以上。在产品打磨阶段,有些SaaS公司几乎是没有销售的,这意味着前期主要靠输血,后续做大做强才有收入来源。

比较头疼的是:科技公司的研发成本往往不低。以国内为例,一线城市有经验的技术性人才,平均工资在1.5万以上,即使开发是30人的小团队,加上配套人员,每月花在人力上的成本基本都过了50万,一年下来至少几百万,这显然不是轻量型创业团队能负担的。

资本的力量,进一步促成这一局面。综合对比新手和老手的创业成功率,资本方在选择项目时,往往倾向于选择有一定行业沉淀和客户资源储备的创业团队。比如在硅谷,一线VE/PE对SaaS项目的投资,更倾向于30岁以上的创业团队,要求教育良好或技术娴熟,拥有长期合作经验。

国内这一领域的投资,基本也是2B老司机占大头。比如2014-2017年间,理才网、纷享、销售易等单笔都揽获上亿投资,年轻创业团队获得的投资顶多在百万、千万级别,很大程度上就是投资方综合商业模式、产品实力、市场表现、用户基数等进行评估的结果。投资额度不高,并不是因为年轻创业团队的项目不出色,只是留给零经验的他们试错的资本不会太多。

这是资本方规避投资风险的手段,也是投资理性下行的表现。毕竟投资不是做慈善,它本质上是趋利避害的,创业者需要资本取暖续命,投资方则急着套现离场。两者不冲突,可各有选择。

未来风向哪边吹?

眼下,70后创业老兵还是推动国内SaaS产业发展的主力军,但涌现的新面孔越来越多。比如上面提到的Dropbox、OneAPM、Teambition等公司的创始人,清一色80后90后。虽然从资历看他们还是行业新兵,技术知识方面的储备却相当不俗。

比如云存储巨头Dropbox公司的创始人Drew Housto,典型的80后,14岁开始兼职写代码,年纪轻轻就已经是Bit9、Accolade、Hubspot等曾任职公司技术开发的一把手。联合成立Dropbox后曾担任CTO,主导了产品的架构和开发,后任职首席执行官。

由于大量国际资本的涌入和“双创”热潮的推动,国内创业年轻化趋势较之国外并不逊色,甚至有赶超之势。

在最新一次调查中,00后SaaS项目创业者,比如风暴云文档CEO王逸翛,也开始在业内崭露头角。和60、70后SaaS创业者相比,新一代年轻的创业者在技术方面的背景有所淡化,演讲、营销、产品运营等方面的才能不断加强。技术合伙人模式和大范围人才招聘,一定程度上形成了互补。

从目前看,国内外市场发展的差距依然在,不过随着企业服务市场活跃度和开发力度的持续加大,可以预见的是:SaaS产业发展的差异在进一步缩小。政策、资本、市场成熟度是一方面,各年龄段新势力的加入,也将是一大推手。

(本文首发钛媒体)

-

观点

观点

未来智能办公升级,阿里、腾讯角逐企业服务战场

编者按:本文来自第一财经,作者:段倩倩

2014年5月,在突袭微信失败后,阿里巴巴社交软件“来往”团队中以陈航为首的几个成员搬进了湖畔花园,来往在这里改头换面为主打企业社交的“钉钉”,陈航的职位变为阿里钉钉CEO。

钉钉不断升级,11月19日,阿里钉钉在深圳发布钉钉4.0版,并发布了三款配套的智能办工硬件产品,钉钉智能前台、钉钉智能通讯中心和钉钉智能投屏。

已经很难再用企业社交软件去定义钉钉。社交只是入口,钉钉已经变成一个平台,一个to B的企业服务提供商。在中国,依靠企业服务成为独角兽的公司少之又少;而在美国,仅Oracle、SAP、Salesforce三家公司的市值已经超过了3500亿美元,在投融资战场上展露峥嵘的公司中,to B和to C势均力敌。

毫无疑问,中国企业服务市场还是一片蓝海,在这个市场跑马圈地的公司不仅是钉钉一家,企业微信悄悄推陈革新,功能不断优化;美团大象则是小荷才露尖尖角。

突袭微信失败后,钉钉显然走向了一个更广阔的市场:企业服务。用陈航的话,钉钉赶上了风口,中国中小企业从传统的纸质办公时代,进入云和移动时代。

但某种程度上这只是一个美好蓝图。一财科技记者采访发现,即便已经是钉钉用户,一些企业在员工入职等事项上还是表现“保守”,重要资料、流程不会通过电子档来保存和审批。

阿里、腾讯角逐企业服务战场

放眼全球,主打to B、企业服务的公司已经在科技领域登堂入室,如SAP、Salesforce、Infor等。这些公司“低调而神秘”,获得不菲融资成为行业独角兽。而在中国,几乎所有的互联网公司都以C端为导向,庞大的C端用户缔造了BAT王国,缔造了美团、滴滴、摩拜等独角兽,但鲜有to B公司展露峥嵘。中国企业服务市场还是一片尚未开发的价值洼地。

盯上企业服务市场的公司不只阿里钉钉一家。钉钉曾经无法撼动的社交巨头微信,也在反攻企业社交,2016年4月,微信上线专门面向企业的即时通讯软件微信企业版,并为企业提供解决方案;美团团队内部孵化的美团大象被认为是钉钉的有力对手,当匿名社交平台出现爆料称接到公司下发的战书“2018年第二季度把钉钉干趴下”时,大家普遍猜测这个公司是指美团,尽管后者曾经予以否认。

钉钉和企业微信的优势是基础版免费。双十一期间,钉钉推出了硬件产品M2的“酷公司0元购机计划”,钉钉企业在提升自己移动智能办公能力后,可以免费获得这款产品。对于美团大象来说,“新美大”下游众多小型商家接近形成自有生态,美团点评推进的技术开放平台,也透露了建立为中小消费商家服务的生态想法。

在亿欧企业服务副主编黄志磊看来,钉钉和企业微信面临的共同缺点替换成本相对较低,一旦企业进入中大型阶段,定制产品的适宜性会替换掉钉钉和企业微信。

与此同时,Infor、Salesforce等国际企业服务巨头已经在进入中国市场。中国企业服务市场会是什么格局?是否会像生活社交、电子商务那样形成一家独大之势,还是钉钉、企业微信、美团大象三足鼎立,或是被外企通吃?

“目前来看中国企业更接地气,中小企业会更喜欢;大型企业市场定制化依然是主导,但更多是在细分业务模块开展定制。”黄志磊称。

和美国企业服务市场大中型企业贡献主要营收不同,在中国,中小企业才是主角,中小企业是市场服务主体。在4.0发布会上,陈航宣布钉钉企业用户数已经达到了500万。此前陈航也曾在接受采访时透露,钉钉用户以中小企业居多。

黄志磊认为,企业服务每个业务模块太多,市场最后不会只剩几家巨头存在,共赢局面是可以期待的,“中小企业做企业服务可以占据长尾市场,可以做生态系统中的小草角色。细分领域市场机会依旧存在,在细分业务管理模块、流程设置以及技术改造上,足够小的市场也有百亿水准。”

-

观点

观点

央视批在线教育“变味”,在线教育的野蛮生长环境要结束了吗?

编者按:本文来自芥末堆(jiemoedu),作者:怡彭。

近几年我国在线教育产业发展迅猛,涌现了VIPKID、猿辅导、一起作业等多家新锐独角兽企业。而任何一个产业的野蛮生长都是有时限的,对于在线教育来说,这种信号也早就释放过,在今年两会期间,全国人大代表周洪宇就提交了《关于加强互联网教育立法的议案》,建议加强和完善互联网教育相关的法律法规。

而就在昨天,关于规范在线教育产业的信号再次传出,中央电视台新闻频道在昨日以《变了味的学习APP》为题,对目前的在线教育平台缺乏监管与资质的问题进行了报道。

在这段时长七分半钟的新闻中,云朵课堂、作业帮和阿凡题等多家在线教育公司被点名。而从资质问题上看,所有涉及在线教育服务的公司都有涉及不合规的可能性。

央视报道:无审核,开办在线网校仅需五分钟

云朵课堂是央视此次报道中主要提及的企业。根据公开资料,云朵课堂是一家提供在线教育网校系统、网校搭建的解决方案提供商。在其官网内,有包括“五分钟独立网校上线”、“无需美工与编程”等宣传字样。

云朵课堂的工作人员对央视记者表示,个人开办网校只需提供身份证即可,企业用户也仅需双方盖章签字,没有任何其他要求。在面对是否需要教育相关资质的问题时,云朵课堂方面称:“主要的资质在我们这边,您其实算是我们的一个小分支。”

此后,央视记者进一步追问是否任何人都可以开办一个在线教育平台,云朵课堂的工作人员也给出了肯定的答复。

央视的报道称,这样的问题并非个例。包括被报道所提及的作业帮、阿凡题,目前在网页及App端上有大量提供教育培训服务的公司及品牌,但多注册为科技公司,并未向教育相关主管部门注册。

2000年,教育部在《关于加强对教育网站和网校进行管理的公告》中明确,凡在中华人民共和国境内,举办冠以中小学校名义或面向中小学生的网校和教育网站,必须经省级教育行政部门同意,并报国家教育行政部门核准。

根据这份文件,央视在报道中认为,大量在线教育公司都存在资质问题。而由于没有被纳入监管范围,在线教育也暴露出了内容涉黄、教师虚假宣传等严重问题。

办证无门?法规亟待明确

北京市教育科学研究院信息处副处长唐亮对央视记者表示,大多数以App形式提供的在线教育服务的公司,都以商业机构的形式进行注册,少部分地区对此类互联网信息服务的前置审批有相应的要求。但从大区域来看,还没有形成明确有效的管理制度和措施。

一位业内人士对芥末堆表示,形成目前的状况主要有两个原因。首先,大多数公司在创立之初并没有提供实际的辅导、培训服务,而是以题库、拍照搜题等产品为主,因而必须以商业性质的科技公司名义进行注册。其次,在目前的政策法规与实践中,在线教育公司很难拿到《办学许可证》等相关资质,几乎不具备可操作性。

事实上,有关在线教育资质的讨论在很早之前就已开始。2017年6月末,国家新闻出版广电总局针对“新浪微博”、“ACFUN”、“凤凰网”等网站在不具备《信息网络传播视听节目许可证》的情况下开展视听节目服务的问题,做出了关停整改的处罚决定。而根据芥末堆的调查,教育企业中仅有清大学习吧和新东方在线持有该许可证。

且与《办学许可证》的状况类似,除现有的588家持证网站外,该证书现在几乎不再发放。一不愿透露姓名的在线教育从业者表示,“在线教育基本不涉及敏感的内容,在视听许可证方面相对还比较安全。但随着官方媒体对资质问题的关注,在线教育很可能会面临更严格的监管。”

民促法已正式实施,在线教育新政将至?

不只是在线上,整个民办教育领域的“合法身份”问题都是悬在所有教育培训公司头上的达摩克利斯之剑。自2017年初起,上海就曾连发多项政策与措施,对教育培训机构进行整顿。据公告称,上海在六月即已梳理出教育培训机构近7000家,其中证照齐全的2000多家,有营业执照但无教育培训资质的3200多家,无照经营的有1300多家,并开展了关停无照经营机构、整改无资质企业的措施。

但对整个民办教育行业来说,2017年仍是一个充满希望的年份。随着新修订的《民办教育促进法》于九月一日正式生效,经营性的民办教育机构终于获得了合法的身份。各地实施细则的陆续公布,也被认为是结束培训机构无序竞争和各类乱象的利好。而随着在线教育的重要性、行业占比日益提升,家长学生、老师以及行业内,也都出现了对行业规范化的诉求。

中国人民大学教育学院教授程方平在接受央视采访时表示:“在线教育确实应该有一个基点,这个底线被突破后就会出现很多问题。包括知识的错误传播、以及用不正确的方式进行教授等等。最重要问题则是没有人来进行判定,广大消费者在这方面并不专业。因此相关的立法应该尽快出台。”

据消息人士透露,与在线教育相关的立法的确正在酝酿之中。而对于“新政”所带来的影响,某大型在线教育公司高管对芥末堆表示:“政策法规上的规范化是一个新兴行业发展的必经阶段,而相关立法对行业发展的实质影响,可能在于提高准入门槛,并让已经存在的差距继续拉大。”

有分析人士指出,师资问题可能是在线教育在监管层面要面对的核心问题。例如以外教为主打的教育平台们,需要解决海外老师的资质认证问题,而以公立学校老师兼职为主的K12平台,也有很大被整顿的可能性。此外,在近年来多次出现的培训机构跑路问题,也并不排除发生在互联网教育公司中。针对线下培训机构所设立的“保证金”制度,可能也会被引入到对在线教育的监管中。

新政的到来,或许将意味着狂奔数年的在线教育将告别野蛮生长,进入新的时代。

扫一扫 加微信

hrtechchina

扫一扫 加微信

hrtechchina

观点

观点

观点

观点

观点

观点

观点

观点

观点

观点

观点

观点

观点

观点

观点

观点

观点

观点

观点

观点

扫一扫 加微信

hrtechchina

扫一扫 加微信

hrtechchina