workday

Workday收购客户管理工具Pattern开发团队,后者平台已停止服务

日前,成立两年的加州创企Pattern背后的开发团队被悄悄收购,收购方为财务管理和HR软件公司Workday,后者已于2012年上市,市值约209亿美元。

两公司未公开此次交易的条款,Pattern CEO Derek Draper在自己的领英主页宣布了收购消息,但拒绝进一步置评。作为交易的一部分,Pattern已于上周末停止Pattern服务。

Pattern的目标是为销售人员减轻管理客户关系的负担,成立以来,该公司获得了Felicis Ventures,SoftTech VC,First Round Capital和多位天使投资人的支持;去年,这些投资人对其进行了250万美元种子轮投资。

Draper和他的联合创始人Zack Moy以及Josh Valdez均曾就职于谷歌,一年前,Draper和5位同样出身谷歌的同事一起运营着公司。Draper和Valdez早先在社交媒体营销公司Wildfire就已经结识,后来这家公司在2012年被谷歌收购。

在领英主页上,Draper写道,他和团队都“非常高兴踏上一段全新的征程”,并期待在Workday“开创未来”。

Workday过去的收购案还包括:去年收购大数据分析公司Platfora,以及在线学习公司Zaption(该平台在交易后随即关闭),这两笔交易的条款均未获透露。

【猎云网(微信:ilieyun)】8月17日报道(编译:LOVEWINS)

workday

刚刚,Workday宣布开放Workday Cloud Platform 进入Paas市场。

刚刚WorkdayCEO Aneel Bhusri 在拉斯维加斯举行的workday Altitude大会中宣布,开放其Workday Cloud Platform 进入Paas 市场。详细地址可以看 这里

Aneel 解释了为什么要进入,以及客户和伙伴们的强烈需求。同时比喻Workday 很像阿波罗登月计划一样,一步一步的来。第一步是HCM ,第二步是国际化,第三步是财务,第四步是棱镜分析与规划,开放平台则是第五步!

我们附录下Aneel 的英文全文帮助大家更好的了解:

“When will Workday open up its platform?”

This question is one of the most frequent ones we’ve received over the years from customers, analysts, and employees alike. And we have always been clear with our response: While opening up the platform was a likely possibility in the future, we needed to stay focused on more immediate priorities for our customers and the requisite needs of our application development teams. Indeed, we had to ensure our technology core offered rock-solid reliability and scalability as well as the flexibility to continually evolve with a rapidly changing business landscape.

Today, we are ready to take a big step forward on our extensibility journey by announcing our intent to open our platform to customers and a broader ecosystem of partners, independent software vendors (ISVs), and developers. The news was shared by our Chief Technology Architect Jon Ruggiero at Altitude, our annual conference for the Workday services ecosystem. This announcement followed an exciting platform hackathon that took place earlier at Altitude and validated that we are on the right path.

And like everything we do, we based our decision on customer input. Simply put, a growing number of customers have been asking for a more open Workday platform. They want to use Workday as a cloud backbone that supports cohesive, digital workflows across multiple business applications—reflective of how their people work and how their businesses operate in today’s hyper-connected, real-time world.

By opening up the Workday Cloud Platform and entering the Platform-as-a-Service (PaaS) market, Workday intends to enable customers and our broader ecosystem to use our platform services to build custom extensions and applications that can significantly enhance what organizations are able to accomplish with Workday.

For instance, customers will be able to create new tasks and business processes to consolidate workflows and they’ll also be able to integrate external applications with Workday using new APIs. This is just a sampling of what will be possible when opening the Workday Cloud Platform, and we’re looking forward to exploring all the ways we can empower our community to develop solutions for more unique business needs, while continuing to benefit from Workday’s contextual data, robust security, battle-tested scalability, and engaging user experience.

While it’s still early days, I believe that opening up the Workday Cloud Platform will prove to be one of most important moves we’ve made since starting the company back in 2005. As a big fan of the Apollo missions, I have been fond of comparing Workday’s strategy to the process of sending a rocket to the moon. HCM was our first booster rocket that launched the company, international expansion was the second stage, Financial Management was the third, and the combination of Planning and Prism Analytics was the fourth and most recent step in our journey. Opening up the Workday Cloud Platform and entering the PaaS market will be number five—a major step for Workday as we continue to innovate and bring increasing value to our customers.

It’s an exciting time for the Workday community, and I look forward to sharing more about this next phase of our journey together in the coming months (hint hint Workday Rising in the fall).

—Aneel

workday

王兴:下一波互联网的方向是2B行业的创新,中国2B行业一定会赶上

我在2013年的时候做了一个事,美国科技界或者互联网圈的资本市场、科技业和互联网信息产业,美国的上市公司,我把它拉了一个名单,中国也拉一个名单,事实上中国从总体上来说发展是跟着美国走的,因为美国可能是先遇到了,很多创新技术先到了,所以我当时看说有哪些产业在美国已经产生了很牛逼的公司在中国还没被真正做起来,而且这个产业将来如果时机具备的话也会在中国是很牛逼的公司。

这个方法论非常简单,我就把美国拉一个名单,把中国拉一个名单,来对比,我这个对比完了之后发现一个让我非常震惊的事,美国的互联网公司,很牛逼的比如facebook、Google、亚马逊,都是非常牛逼的,但是美国上市的科技公司里还有另外一派,也非常牛逼,只不过是这一派没有像互联网公司这种曝光多,名气大。

但是这一派其实都很挣钱,比如说salesforce,比如说workday,他们基本占据科技业的另外一半,在科技业的一半是to C的公司,他们占了一半的市值,在2012、2013年的时候,to B的这些公司占了另外一半市值,比如说Oracle,他们占了另外一半市值。所以其实还有很多很牛逼的公司,但是我们把这个来看中国的话发现中国to C的公司都很牛逼,最大的是阿里,然后是腾讯、百度,to B的公司居然找不到,基本上找不到,就是说有活着的,但是活得很惨。

所以我就很纳闷,为什么中国这些to B的企业活这么惨呢?为什么美国能产生这么大的to B的企业中国产生不了呢?我就很纳闷,所以我就找了一些我认为比较有真知灼见的人交流,其中有一个人还是比较牛逼的,给了我一个答案,我认为这个答案是比较真实的,他说你看这是美国的to B科技企业做出来的,都是给企业或者给商家提供解决方案的。

我刚才说的salesforce是销售团队管理解决方案,workday是HR解决方案,都是给企业和商家提供解决方案的。为什么这些提供解决方案的公司在美国活得很好,在中国活得不好呢?原因非常简单就是美国这个国家商业周期非常长,因为商业周期长,所以任何一个企业所有能用来竞争和发展的东西基本上都用光了,他们的发展出现瓶颈了,当他们出现瓶颈的时候就开始搞内部提高效率,降低成本,创新服务。

而他们要搞内部提高效率、降低成本、创新服务的时候,他们没有这些技术支持做不了,所以说白了就是美国的企业在过去这些年率先遇到了市场红利枯竭的状态,因为遇到市场红利枯竭,它就要寻求自己的效率成本和创新,它要寻求自身的效率成本和创新的时候就对各种新式的能提高效率降低成本的各种工具开始产生兴趣。

而过去中国这些年是什么情况呢?傻逼经营一个企业都能赚钱,这么说好像我们比傻逼还不如,我们还亏钱呢,我们是战略性亏损。我这么说,你们可能说我言过其实,但中国过去这些年实在是赚钱太容易了,当然了,大部分人存在的问题是不具备可能知道这个事情很容易赚钱的认知或者不具备进入这个行业的资本,其实中国过去很多行业是极其赚钱的,非常多。

我给你讲几个赚钱多的例子,因为这样的原因导致什么呢?大家说我这个企业搞得很好,发展很好,赚钱很好,我为什么要冒风险去用你新给我提供的产品呢?我为什么要冒险使用一个salesforce呢?salesforce是一个很难用的产品,虽然这个公司非常非常值钱,但是是一个非常非常难用的产品,而且非常非常贵。

所以我们为什么要冒这个险呢?没必要,因为企业发展很好。所以这是根本原因,也就是说因为过去这些年整个中国市场、中国企业的发展特别容易,靠市场红利驱动就能发展,就能赚钱,所以他们对于新工具、新方法的采用意愿特别特别低,所以这时候有人说我给你们公司做一个工具你要不要买,他根本没有兴趣的。

走到今天,我认为这个事情发生变化了,所有的企业,所有的商家的经营因为遇到障碍了,所以当它的销售额不涨、利润不涨的时候它就要想办法提高效率,创新服务,想法降低成本,它自己没有办法。

最近一段时间里面,我的判断是下一波中国互联网如果想回暖的话,一个非常重要的方向是供应链和to B行业的创新,是他们驱动的。所以这是供给侧,这是回到我说他们过去存在的问题以及可能有的解决方案,所以我们来看供给侧,如果要做改革的话,可能有哪些变化,有哪些变化能实现他们的创新,实现效率成本改变。

一、管理。其实我们中国企业的管理水平是非常非常差的,你们难以想象。我原来也挺自卑的,觉得我们互联网企业,因为发展速度太快了,管理很差,而且很多传统企业的HR,那些大牌公司的HR,一问我们互联网企业的情况都面露鄙夷之态,你们互联网企业太糟糕了。所以我内心一直对于我们互联网企业的管理包括美团点评的管理非常自卑,但是过去的几年,我对这个问题的看法有一个极大的变化。

二、战略差。跟很多传统企业的老板交流,问他们说你们公司战略是什么,大概有一半回答这个问题很明显是现场随口讲的,有90%的回答出的那个战略,那句话的陈述方式就明显是战略的陈述方式,有90%的。在剩下的10%里面,那个战略不是一个可行战略,中国企业的战略能力太差了。

三、营销太差,都是无差别营销,都是效率极低的营销。

四、经营水平太差。帐算不清,我们这个行业应该见很多餐饮商家,你们认为你们服务的这些餐饮商家里有几个能够把他的帐算清的?我认为在餐饮行业里能够把帐算清楚的商家不超过1%,很多商家莫名其妙的倒闭了,而且看起来很牛逼的品牌,你跟他聊聊,他连帐都算不清,经营水平太差了。

五、技术理解能力、技术应用太差了。过去这些商家根本就没有科技意识,为什么到互联网来的时候,中国的电商把中国的零售全部打惨了,美国虽然零售业压力很大,但是美国的沃尔玛和亚马逊打了很多年,原因非常简单,沃尔玛这家企业,美国的传统企业技术实力是非常强的。

我讲一个例子你们就知道了,亚马逊大家现在公认是一个科技企业,亚马逊的第一个CTO是沃尔玛的CIO,也就是贝索斯作为一个横跨科技业与互联网的人,他在成立亚马逊的时候第一想到的人不是去微软招人,也不是去雅虎招人,第一想到的是去沃尔玛招人,可见沃尔玛的技术有多强。

沃尔玛的技术有多强我讲一个例子你们就知道了,沃尔玛这家公司是有自己的卫星的,觉得技术够强了吧。

所以在美国,任何行业都是科技业,开超市的这么一个公司人家都做科技,也是一个科技公司,这就是美国和中国的差别,中国有渠道公司,有营销公司,有零售公司,有培训公司,这些公司渠道公司就是渠道公司,零售公司就是零售公司,销售公司就是销售公司,营销公司就是营销公司,在美国所有公司都是科技公司。所以中国对于科技的应用太差了。

六、供应链产业的结构太差了。供应链产业结构是什么呢?比如说中国,任何一个餐厅,他从哪儿进货,没有专业的供应商,在欧美都是有专业公司的,所以他们的效率极高。

这些都是我们整个供给侧现在存在的巨大问题。面对这些供给侧存在的巨大问题,跟我们有什么关系呢?关系巨大。因为其实从我刚才讲的这些要素里看到,从我们刚才讲的要素里看到,我们习大大提出要搞供给侧改革,我们的商家,我们所面临的商家本质上就是供给侧,但是问题在于他们是否有可能自我革命,自我提升呢?不可能,这是不可能的。

所以对于我们来说,我们是有希望通过我们的努力来帮助我们整个产业实现这次供给侧改革的。而这次供给侧改革一个非常重要的驱动力就是让整个中国的产业供给侧实现互联网化、数据化,因为实现互联网化、数据化,在这基础上提供更多的解决方案,通过这些解决方案实现让整个我们产业的供给侧商家经营再上一个台阶,通过他们的效率提升、成本改善、服务创新,让我们的消费者享受更好的服务,推动整个产业发展。

大家不要格局太低,把我们做的事情理解为我们这个公司要怎样,我们要从产业角度出发来看我们这个产业要向哪里去。我有一个判断,我认为整个中国的餐饮行业的成本和效率有25%左右的改善空间,这是一个非常恐怖的空间,因为大家知道它的净利润也没多少,我的判断根据我过去一段时间对整个产业的了解和经营情况,各种经营如果改进,我的判断是有25%的改善空间。而这25%左右的改善空间,我们等它来是不可能的,必须我们来驱动它,所以这是我们整个美团点评这家公司在整个中国服务业里面,在当前的国际国内经济形势下我们所承担的使命,我们要通过互联网和科技改造,为整个中国服务业的供给侧改革这次升级提供驱动力,推动整个中国的服务业率先完成供给侧改革,完成习大大交给我们的工作。这是我的整个的分享的上半场。

workday

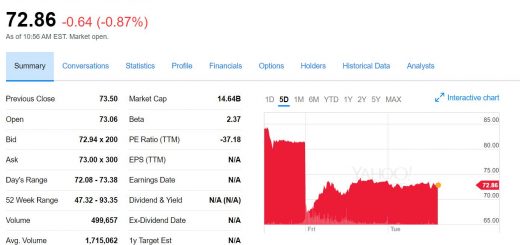

Workday发布财报后,股价大跌,原因是前景显得不明朗

这几日Workday发布最新一季财报后,股价大跌11.4%,虽然这个季度收入增长了34.2%,达到了4.096亿美金,其中订阅服务增长了38.3%,达到了3.357亿美金,专业服务收入增长了18.1%,达到了0.739亿美金。

Workday首席执行官Aneel Bhusri 谈到第三季度业务增长强劲,在不同的市场和行业的表现都非常棒,产品差异化,技术创新,真正的客户成功等这些都是区别市场的不同。

但是他也指出在未来也有很多不确定性,比如美国的大选,其他八国集团领导人的选举等都会是一个影响。但是希望这个不确定性是孤立的,短暂的。但是这个必须要注意。

第四季度他很乐观的预计收入4.27亿美金到4.3亿美金。同比增长32%到33%,其中订阅收入3.6-3.63亿美金。

基于本季度的强劲收入,也提高了全年的收入预期,15.6亿美金-15.63亿美金。

即使如此,依然挡不住未来的不确定。

不过小编认为,这个时候可以入手workday了!73美金的价格可以持有,80多的时候抛掉。做短线是没问题的。这一年来,如此情况出现了好几次。如果短线的话,会有不少收获。特别注意这一段不作为投资参考,也不负责!

workday

在线学习平台 Zaption 被 Workday 收购 ,将于9月30日暂停服务

Zaption 是一个教育互动视频制作平台,在 Zaption网站上,老师和公司都可以在网站上发布视频,或者将现有视频用户教学。6月30日,该公司宣布被人力资本管理软件公司 Workday 收购。Zaption 的服务将于9月30日关闭。具体收购详情没有披露。

在 Zaption 的网站、iOS app 和Chrome app 中,老师可以使用其提供的工具在视频时间轴上嵌入题目,学生观看学习时,视频会在有题目嵌入的地方自动暂停,学生完成屏幕中或屏幕右侧的小测验后,即可继续观看。付费版本有更多高级功能:老师可以建立学习小组,还可以看到每个学生的视频观看进度和答题数据分析,制作完成的视频甚至可以被转移到站外,比如学校的 LMS。

Zaption 团队表示,Workday 服务于很多全球范围内的大型公司和教育机构,有更好、参与性更强的学习体验,很高兴自己的技术能成为 Workday 应用的一部分,包括非常值得期待的 Workday Learning 的一部分。

Zaption 成立于2012年,公司位于旧金山。曾在2015年获得150万美元种子轮融资,投资人包括NewSchools Venture Fund、Redcrest Enterprises、 Scion Capital 和 Telegraph Hill Capital。

本文参考信息来源:venturebeat.com

workday

赛诺菲HR VP解读为什么用Workday取代SAP HR,我们能从中提炼出什么?

作者:朱暑冰 微博地址:http://www.itwzx.cn/archives/229

赛诺菲,全球五大药业巨头之一,其HR VP Denis Sacré在workday 2015的欧洲Rising大会上站台,解读为什么选择workday来代替SAP HR(不过其他的系统仍然保留SAP,估计是ERP和财务)。客户大佬站台背书,如果放国内绝对是一个销售和Marketing手中的重磅炸弹,满世界去攻城略地了。但千万别自行脑补workday比SAP、Oracle产品好,或SaaS比On premise好的结论,仔细读完全文,可以发现并没有介绍什么压倒性的优势,最终胜出的理由甚至可以理解成决定天平倾斜的最后一根稻草,不过从该HR VP话语的细节中可以提炼出很多有价值的内容,这才是听成功案例的正确姿势。

首先摘录该HR VP的话语细节:

2011年,赛诺菲计划其第一个全球性的SAP HR项目,当时SAP已经收购了SuccessFactors,考虑到未来十年一定是云的天下,如果采用SAP on-premise的方案,4年的实施期后还需要两年迁移到云,所以赛诺菲打算一步到位。由于当时Oracle的云产品(应该是Fusion)还未就绪,所以候选者只有workday和SuccessFactors。

2012年底,workday最后胜出,理由有两点:(1)Workday从第一天起就是以核心HR为定位来开发,集成性非常好,易于使用,这一点在决策中非常关键和具有决定性。反之,SuccessFactor使用不太顺畅,集成性方面有断点。(2)在被问到,如果赛诺菲实在需要定制化,能否被满足时,workday明确地拒绝,而SAP回答含糊。而赛诺菲期待的答案是No,因为期待一个纯云的解决方案,只希望通过配置来解决个性化需求。

三年过后的今天,整个实施推广还在进行中。实施并没有采取全面铺上的模式,而是从2013年后半段开始,首先上马人才管理、绩效等模块,因为对于赛诺菲来说,人才管理非常关键,具有压倒性的地位。这一部分于2015年上半年完成,推广到了全部11万员工中的75000名白领。

同期,赛诺菲开始设计全球铺开workday核心HR模块的流程,以取代地区和业务单元层面的现有SAP、Oracle、Peoplesoft等系统。由于历年的收购和合并,不同的HR系统实例多达500个。

核心HR的铺开首先是欧洲国家中的德国、瑞士和奥地利,覆盖约9000名员工,然后是北美的19000名员工,最后是剩下的欧洲国家等,约40000名员工。

通常的HR系统实施顺序是先核心HR模块,然后扩展到人才、薪酬等其他模块。赛诺菲决策首先上马人才管理模块,有其业务上的必要性,但也是非常危险和大胆的。风险和复杂性在于需要workday和SAP系统的双向复制、数据同步。组织架构数据由workday为主维护,个人数据由SAP为主维护,多达60多个字段的数据需要双向同步。系统上线后,做到了这一步,但并不是100%。时至今日,每周仍有2%的修正工作需要做,带来了大量的工作负荷,workday和SAP系统的数据架构和处理方式差异太大了!

当核心的HR模块在全球上线后,简化HR系统这一最初的目标才真正实现。以前多达500个HR实例的情况将不复存在,中间的过度系统也不再需要。

为了确保系统被顺利使用,赛诺菲录制了500个一小时长度的WebEx演示视频,在总部有两打的倡导者宣传,全球还有400多位问题达人随时解答大家的问题。Workday的产品也非常易用,大家感觉和他们在2C市场上使用的APP一样易用,员工们很容易从LinkedIn导入他们自己的介绍,然后增加一些如职业偏好、职位期望、是否愿意赋新职等,结果80%的员工都完成了自己的介绍;经理们也很容易利用九宫格给员工绩效评分,设定继承人计划等。

workday系统当前还存在的问题:(1)系统可以BI下钻分析,可以直接钻透到详细数据并直接操作,但有10000个记录的上限约束,因此无法为执行委员会提供数字仪表板,因为某些高层领导下属的数量超出该限制;(2)对于赛诺菲这样的大型复杂企业来说,不同业务单元的管理层级不同,这一点workday的标准化处理方法不够灵活;(3)workday的绩效不能涵盖非正式员工;(4)系统的安全性设计不错,但也为人才查找和继任者池操作带来了麻烦;(4)为了屏蔽HR员工看到自己的数据,需要采用变通的方法。

最后的心得总结:(1)云和传统应用差异很大,你必须接受一个固定格式的合同,相对简陋的业务流程。(2)SaaS应用相比传统ERP大大简单,但仍然是一个大工程,千万不要低估安全性、报表、数据迁移、功能模块方面的难度。(3)要有强有力的治理模式,部署速度和完美型方面需要合适的平衡和妥协。

对于甲方,读一个成功案例,客户的结论和总结性词汇一点都不重要,关键是细节描述,因为每一个企业的内部情况都是不同的,对于系统功能或特性的重要性权重也是不同的(比如赛诺菲对于人才管理模块的权重就大于核心HR模块),所以他们的结论不具有参考价值,但细节描述非常具有参考价值,有助于深入、形象地了解产品,为一个不能直接、全面触摸的产品提供体验和感受。

反之,对于乙方,写一个成功案例,直接喊口号,或者定位XX第一的宣传效果很差,即使用著名大公司的名气或者客户数量的多少来背书,效果也未必多好,因为多年以后,大公司不堪的使用情况内幕被爆出来,似乎潮流一样大批客户被别人替换的情况,业内的从业者估计也没有少听说。关键是细节描述,无论是客户的头痛问题、看重的点、实施的细节、最后的效果等,读案例的潜在客户会自己评判、下结论,细节是最具有说服力和可信度,潜移默化影响客户心里天平倾向的杀手神招。

回到赛诺菲案例,有哪些细节值得提炼呢?

(1)、(2)中赛诺菲2012年决策Workday胜出的理由放到今天需要重新考虑,SaaS领域的发展太快,人家几年前的结论现在已不具有参考价值,放到今天,Oracle也许就不会被直接排除在外。

(2)中提到Workday一开始就定位于核心HR,这种涉及出身定位,并不能直接推导出优势结论的理由只有在你所有重要的需求都被满足,其他方面各家产品没有大的优势差别情况下,才能作为决定天平倾斜的稻草。即一开始要考虑具体的大砝码,这种似乎很有道理的论调只可以作为稻草。类似的论调还有:跨平台产品更好,Java平台更好;500强企业都用的应用蕴含先进管理思想;国产的应用更适合国情等。

从(2)中看出评估阶段赛诺菲对Core HR的看重,可(3)、(6)实施阶段的说明又显示人才管理远重于Core HR,评判准则不坚定,随时间推移而浮动是个大忌,类似先射箭然后画靶子,为论证结论正确而找理由。国内的很多项目如果从头跟踪到尾,这样的情况比比皆是。

(2)中提到Workday胜出的另一个理由是workday和SAP对于客户定制化要求是否满足的回答不同,这里有个如何科学问问题的问题。甲方应该清楚告知所问问题的目的是什么,是为了搞清楚什么不明确的东西。国内的读者也许会说,如果我问的这么明确,暴露了我的倾向,乙方可能会为了迎合我而不说真话,那我如何判别不同供应商的优劣呢?这种担心完全可以有别的方法解决(做招聘的人如何判别应聘者言语真伪的方法同样适用于此),但为了这种担心而不把问题说透,一个极大可能的后果是乙方不知道你真正关注的点是什么,问题太大无从回答,只能捡自己理解或当时想到的来回答。这种情况下要正好命中的慨率极低,需要大大考验各家乙方销售的功力,是否能搞定客户透题给你,甚至和你联手炮制这种难于命中的问题。甲方很多情况下说不清楚自己的需求,或者所说的需求不是本源的需求,而是经过了几层演绎后的需求而不自知,结果问简单问题又不告知目的,乙方如果不会或不能刨根问底,层次深入,由于理解不清,即使满肚子经验,可能也帮不上忙,最后的恶果往往是系统上线后,价值平平。

(2)中赛诺菲希望SaaS应用通过纯配置来解决个性化问题的愿望是不现实的,赛诺菲将其列为一票否决的需求是错误的。原文中后面也提到赛诺菲提了一些需求,Workday将其作为欧洲国家的普遍需求,做到了正式版本中。如果不是赛诺菲这样的业界标杆,又或者Workday没有那么迫切需要了解欧洲国家和美国用户的差异,反应速度也许就不能让赛诺菲满意,这时要解决问题又怎么办呢?

(7)中可以看出,赛诺菲本次项目的一个重要目标是全球用一套系统取代分散的多达500个实例的系统,背后具体的业务困扰场景是什么没有说明,所以是否真能解决也不得而知,国内的HRMS供应商似乎对一套系统的解决方案不看好。

(6)中提到,由于没有先上Core HR,造成很长时间的workday和SAP系统双向同步,虽然从决策层角度来说,有人才管理更重要的考量,但随之而来的2%每周修正能把人逼疯。上面领导动动嘴,下面的HR和IT跑断腿。所以这种决策要慎重,要重视给下面人带来的巨大工作量。类似的决策还有很多,如新旧ERP、财务系统的长期并行运行以观察数据是否一致;为了不让一般用户看到某些敏感数据而另外建一套实例等。

(9)中提到,下钻时发现的10000个记录的限制,估计也是后期用到时才发现的。国内的情况也往往是评估时没有细化到要什么报表,需求调研时只提出少数报表,系统上线后,不断增加提出报表需求,理由是没有数据,怎么提得出报表需求。其实这反映出各级领导对于如何洞察业务没有一个全面的考量,事到临头才想起需求,这种需求有时候经过处理可以满足,有时候需要二期修改业务操作流程,采集必要数据才可以满足。洞察业务方面考虑不周全,系统要发挥业务价值就大打折扣,以终为始很关键。

Workday的易用性得到了Denis Sacré的大笔墨描述,无论是员工的简介(Profile)完成率,还是经理层的绩效评分和继任者设定,甚至系统上线后没有专门的培训,而是有问题找专门的问题达人。这说明易用性对于现代应用的重要性,另一方面也提醒我们,一个系统要用的好,背后的管理理念要做好培训,标准化,定义明确,大家理解一致。

(9)中提到的workday当前问题值得参考,如果你对这些因素看重,需要找到解决方法,或考虑别的产品。

第(10)点经验之谈也值得关注,固定格式的合同对于很多公司来说不容易接受;SaaS应用的难度不能低估,别轻信厂商销售的拍胸脯,赛诺菲实施过程历时3年还没完全结束就是一个例证;速度和完美性的平衡和妥协把握不容易,国内常见的情况是前期过于追求完美,什么功能都想要,什么需求都要完美满足,理想主义色彩太浓,后期又迫于进度的压力,轻易放弃一些必要的坚持,甚至可能放弃前期立项时重要的目标,立项设想收获西瓜,结果收获芝麻。

原文《Why Sanofi chose Workday to replace SAP HR》,链接:http://diginomica.com/2015/12/17/why-sanofi-chose-workday-to-replace-sap-hr/

备注:之前一直没找到原文作者,没有署名作者非常抱歉。

workday

workday 发布第三季度财报,亏损超出预期,达7780万美金

据ZDnet消息,企业人力资源管理软件商Workday近日公布了第三季度财报,净亏损达7780万美元,每股约合41美分,收入约为3.03亿美元。汤森路透消息,华尔街此前预计不按照美国通用会计准则的每股亏损为4美分,但显然Workday的亏损已经超出了华尔街的预计。但Workday的前景还是光明的,该公司第四季度营收预计在3亿1700万美元至3亿2000万美元之间,将比去年同比增长40%-41%。该公司表示正在努力拓展金融领域的客户,且称全球最大的保险集团AON(怡安)将使用其公司的金融管理软件。

workday第二季度财报刚刚实现盈利,这个季度又出现较大亏损,更多信息我们将后续报道关注。

当前股票价格略微上涨,达83.11元,总市值达到92亿美金。

workday

#硅谷行回顾# 走进Workday-全球人力资源系统提供商

于上月的HRTech China CEO硅谷参访团,我们有幸到访Workday的总部,由首席人力资源策略顾问Debi Hirshlag小姐正式介绍这家企业云计算应用提供商。 Hirshlag小姐于2012年1月加入Workday成为首席人力资源官,同时也是企业云计算人力资源解决方案行业内的重要权威。

Workday由Dave Duffield和Aneel Bhusri两位好友于2005年成立,他们对软件开发高瞻远嘱,而且具备丰富经验。 Duffield先生于1987年创立PeopleSoft,成为公司的首席执行官和董事会主席,而Bhusri先生则负责多个领导性的职务,包括产品战略高级副总裁。 PeopleSoft于2005年被甲骨文收购后,两位创始人在太浩湖以北一家小餐厅享用早餐时,决定创立新公司。就在当天,他们决意成立一间颠覆企业软件市场的公司──Workday。

时至今日,Workday拥有逾4,500名员工,服务逾1,000家迅速发展且具全球客户网络的企业。有趣、创新、诚信,以客人和社区为本的理念,令Workday的发展远远超越其竞争者,获得领先行内的98%客户满意度。

随着2012年公司成功上市,盈利亦成为公司的营运指标。然而,公司仍竭力在财政表现和员工的健康快乐取得平衡。 Workday很荣幸能为员工提供一个屡获殊荣的工作环境。 Workday曾于财富杂志的“100家90后最理想的工作环境”、”100家最好服务的公司” 及”女士最理想的工作环境”中分别排行第7、22及47名。

Workday为全球大型公司、教育机构及政府组织等提供人力资本管理、金融管理及分析应用程序。与其他在市场的产品不同,Workday人力资本管理程序是一个单一统一的方案,为企业提供全面的关键商务服务。

最重要是Workday人力资本管理程序以为全球移动劳动人口容易适应而设计。

Workday在2015年于亚太区做了重大的投资,当中包括增加了香港及新加坡员工数目至一倍;扩大了东京及悉尼办公室;将香港办公室升级并添加了培训设施。

Workday以亚太区及日本为总部的客户包括联想、大众点评、日产、索尼、日立、伟创力、Thiess和迅销。

附录部分参访嘉宾合影:

[caption id="attachment_9936" align="alignnone" width="1021"] workday[/caption]

关于海外考察服务,更多信息可以访问:

http://oversea.hrsalon.org/

或者直接邮件联系: annie@hrtechchina.com

workday

workday推出一款大数据分析产品,可预测员工何时离职

[摘要]这项软件靠分析员工活动的趋势、最近一次升职是何时、地理因素、产业变化及其他资料来做出预测。

workday推出一款 大数据分析产品,该软件可以预测员工何时离职。

报道说,好的老板如果感觉到员工不快乐,一般会设法在为时已晚前解决问题。在硅谷的VMware公司里,他们也用到了此款大数据分析产品,他们让机器去办这件事。

据报道,VMware公司一直在测试人力资源软件公司Workday的这款新预测科技。这项系统会通知员工可能准备离职的时间,让主管可以在来不及之前出手挽回。这项软件靠分析员工活动的趋势、最近一次升职是何时、地理因素、产业变化及其他资料来做出预测。经过训练,系统会逐渐进步。

VMware全球人力资源信息系统资深主管加纳威(Amy Gannaway)于9月在Workday会议上说:“有了这些资料,如今我们已有很不错的结果。”她说,这项工具让VMware有“极高机率”正确预测哪些员工会离开公司。

workday

云计算是未来 不过“屌丝”企业还是别玩了

来源:腾讯科技

12月1日,最新一期出版的美国著名财经杂志《巴伦周刊》撰文分析了当前云计算市场的发展趋势。文章指出,与微软等传统软件巨头相比,云计算软件产业的前期固定资产和设备投资过于庞大,导致整个产业陷入盈利困局。不过,由于市场需求旺盛以及产业的规模化发展,云计算产业的未来发展趋势仍是一片光明。

以下是文章内容全文:

上世纪九十年代末的互联网发展给人们最重要的启示之一是:所谓“无缝接入”的电子商务产业需要真金白银作为强大支撑。当前的云计算产业再次提醒人们,盈利才是产业的生存之本。

像老大哥微软一样,当前的云计算软件公司都在销售软件代码产品。然而,与微软提供CD集成版软件不同的是,这些软件公司在各自的服务器计算机上运行软件代码,而需要使用软件的企业客户则直接通过互联网来接入这些服务器就可以了。

自由现金流收益率偏低

这些新兴的软件开发商其实更类似于电信运营商,因为它们需要自己建设和维护大量的服务器才能保障自身软件的良好存储和运行。我们最好把这些软件开发商称为软件“运营商”。由于前期网络和服务器建设需要投入大量的资金,因此大多数云计算软件开发商当前的盈利能力普遍偏弱。

两年前成功上市的Workday正在成为一家颇具实力的云计算软件开发商。在截至明年1月底的2014财年,Workday的财年营收预计将同比大幅增长67%至7.85亿美元。然而在购买房产、办公地和设备方面支出了1.01亿美元后,Workday从云计算软件业务获得的现金净利润却仅为可怜的760万美元。也就是说,其自由现金流收益率(Free Cash Flow Yield, 以下简称FCFY)仅为1%。

而软件巨头微软今年的年营收将达到980亿美元,其FCFY有望达到26%。也就是说,微软今年将有250亿美元现金用于支付股息和回购股票,或者干脆把这笔钱存到银行里。

当然,微软已经拥有近40年的发展历史,与之进行对比似乎并不公平。但纵观整个云计算软件产业,其FCFY和资本集中水平却根本与微软建立起来的高收益业务没有可比性。

在对22家云计算软件公司进行调查后发现,其FCFY的平均值仅为4.5%,并不比互联网零售巨头亚马逊的2%高多少。而亚马逊则是业内利润率最低、资本最为集中的科技巨头。这22家公司包括Workday、在线旅行订票系统Sabre、IT商业软件公司ServiceNow以及营销软件公司Marketo。

股票期权支出大

业内投资者往往都十分关注这些云计算软件公司在股票期权方面的支出表现。今年前9个月,Workday的股票期权支出高达1.17亿美元,占其营收的比例为21%。作为全球最大的云计算软件开发商,Salesforce.com今年前9个月的股票期权营收比虽然仅相当于Workday的一半,但实际支出则高达4.13亿美元。

然而股票期权固定支出却模糊了固定资产支出在营收中的占比。毕竟,后者才是软件公司运行服务器最重要的基础。对于上述22家公司来说,其固定资产支出的营收占比要远远高于微软这样的业内老牌软件公司。

根据市场研究机构FactSet的统计显示,微软在2014财年的固定资产和设备支出在营收的占比可能为6%,占其运营现金流的19%。与之形成鲜明对比的是,上述22家软件公司当前财年的平均固定资产支出营收占比可能会达到8.6%,占其营收现金流的比例则可能高达207%。也就是说,这些公司每获得1美元的现金净利润,就需要支出2美元用于固定资产和设备投资。

这些数字还因各个公司的具体情况而有所不同。云端客户服务处理应用Zendesk在今年前9个月支出了1900万美元用于租赁办公地以及购买服务器和与云服务有关的必要设备,这直接导致该公司的现金流达到负1900万美元。华尔街分析师预计,该公司本财年的资本支出占营收的比例将达到令人难以置信的34倍。

今年,投资者总体上也在一直抛售云计算软件股票。Saleforce的年内股价增幅为8.5%,成为云计算股表现最好的个股之一。而Workday的年内股价增幅则仅为4.7%。

ServiceNow的年内股价涨幅高达14%,这可要得益于该公司已经成为IBM或另一家大型科技公司潜在收购目标的缘故。

市场需求旺盛

那么问题就来了,如果一家公司需要支出2美元才能赚到1美元净利润的话,整个产业为何还会呈现出当前的勃勃生机呢?

简单来说,就是市场需求旺盛。越来越多的企业用户都想通过购买云计算服务而省去软件的运行费用,从而彻底砍掉安装新应用的成本开支。因此,很多年轻的创业公司都采取这种方法与微软、甲骨文和SAP等老牌软件巨头展开业务竞争。

云计算产业的未来曙光在于,随着时间的推移,软件开发商的软件运行成本会变得越来越低。随着云计算软件开发商规模化发展的进一步加深,其新增用户的增量成本将会下降。这就意味着,每个服务器可以为越来越多的客户运行软件,每个服务器所产生的净利润也就越来越高。

与业内的小型竞争对手相比,Workday和Salesforce等大型云计算软件开发商的资本支出营收比或者资本支出与自由现金流之比相对较高。然而,整个云计算产业似乎并没有出现降低固定资产支出的任何迹象,因此要想达到整体营收超过成本支出的拐点也尚需时日。此后,才能出现净利润的井喷式增长。

然而,投资者今年并没有对云计算产业的巨额资本支出给予多大的耐心。(景隼)

欢迎跟帖讨论~

复制去Google翻译翻译结果

ServiceNow

扫一扫 加微信

hrtechchina

workday

workday

workday

workday

workday

workday

workday

workday

workday

workday

workday

workday

workday

workday

workday

workday

workday

workday

workday

workday

扫一扫 加微信

hrtechchina

扫一扫 加微信

hrtechchina